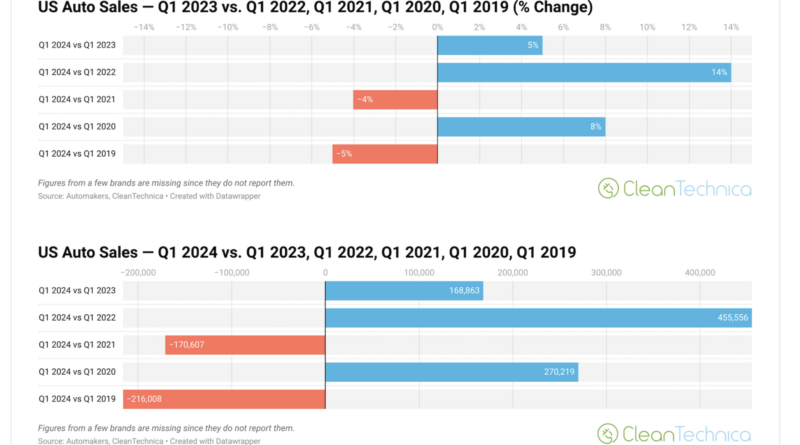

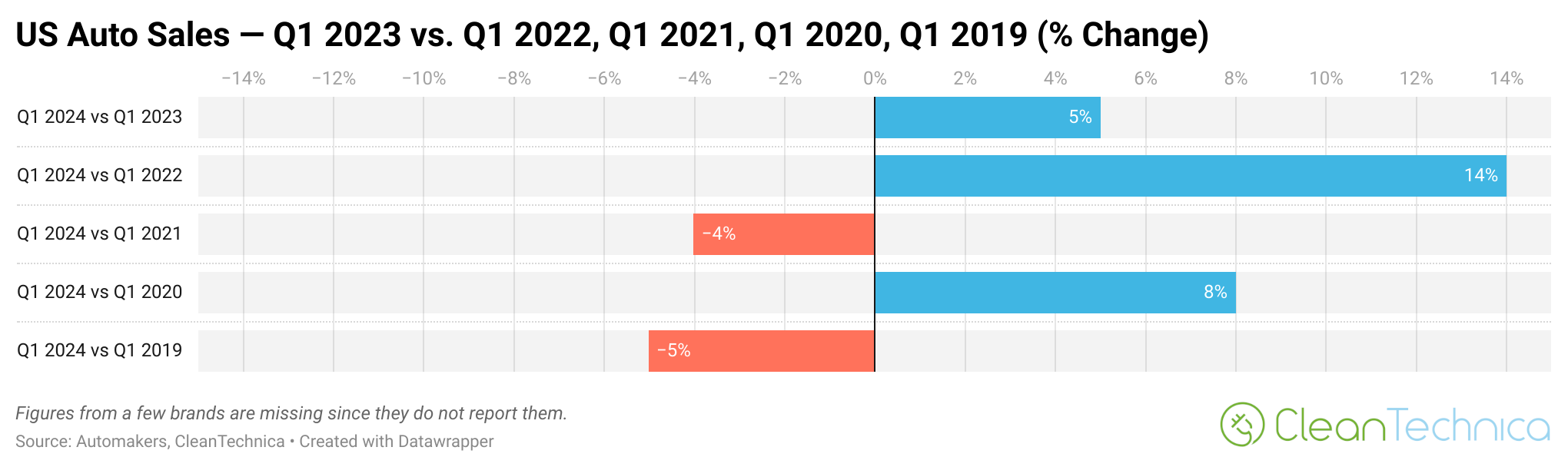

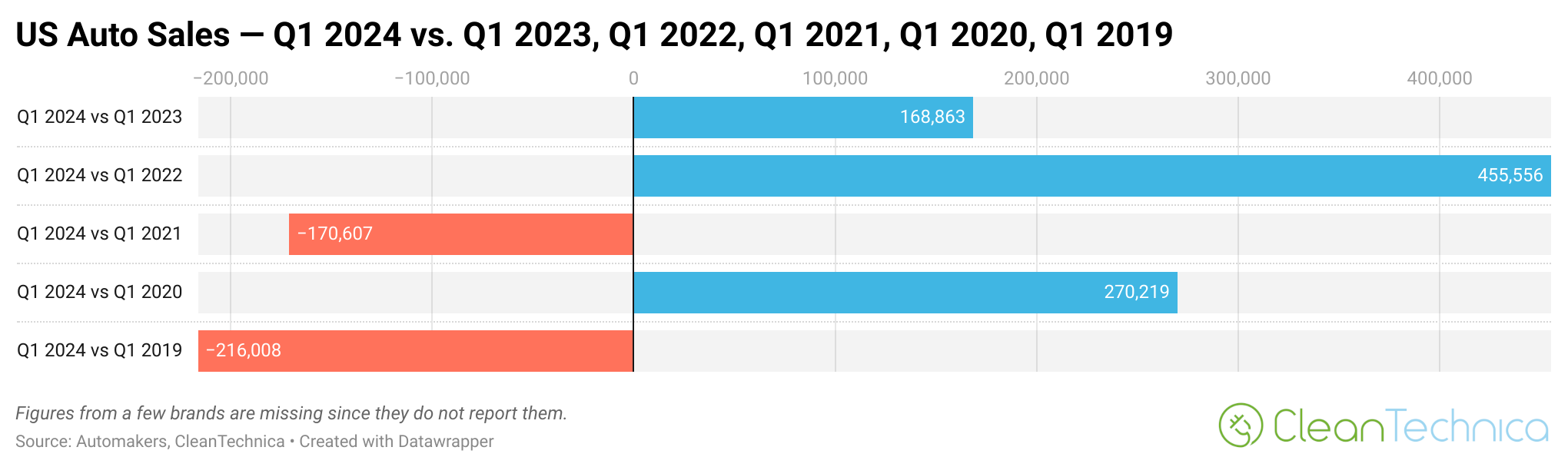

US Auto Sales Up 5% in Q1 vs. Q1 2023, Down 5% vs. Q1 2019

The US auto industry is in a very interesting place. In this US auto industry sales report, I compare 1st quarter (Q1) sales going back 5 years. It’s been an interesting roller coaster, especially due to the COVID-19 pandemic, but now that we’ve gone past that, it’s extra interesting to see what has changed since 2019 (the year before COVID-19 hit). Before getting into all of that, though, let’s first look at the market leaders in Q1 2024.

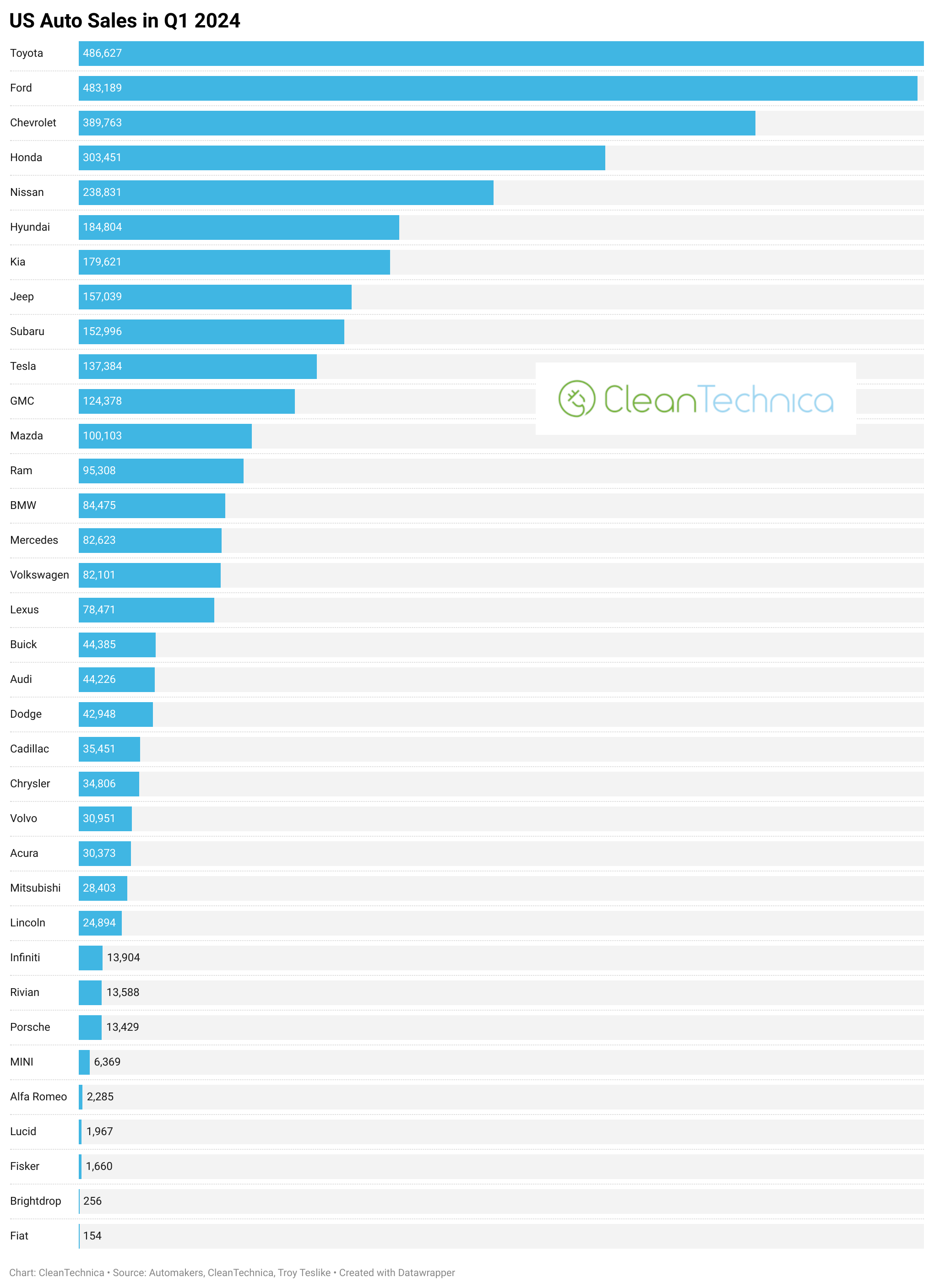

You’ve still got the big 4 of Toyota, Ford, Chevrolet, and Honda. Then you’ve got the solid middle of the top 10 — Nissan, Hyundai, and Kia. And then, to round out the top 10, you’ve got Jeep, Subaru, and Tesla. It’s still a bit of a stunning achievement that Tesla so quickly rose into the top 10 of US auto sales, and even more so when you consider that it only sells two genuinely mass-market models.

Looking at how auto industry sales have changed year over year in the first quarter, we can see that sales were up 5% compared to Q1 2023 and up 14% compared to Q1 2022. They are down 4% compared to the big post-COVID rebound year of 2021, and up 8% over Q1 2020, when the pandemic hit. What is most interesting to me, though, is the comparison to pre-COVID 2019. Auto industry sales are down 5% compared to that quarter in the US.

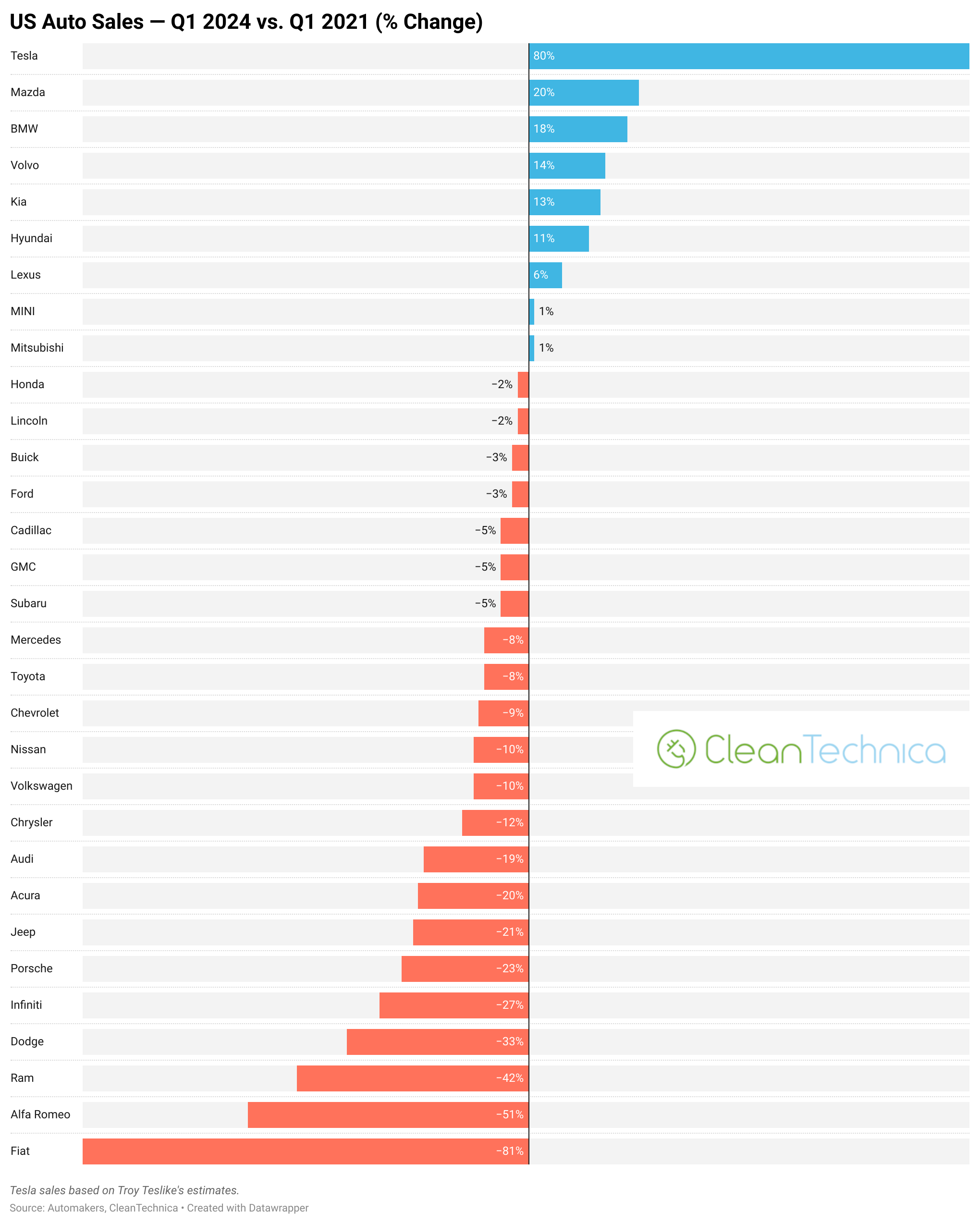

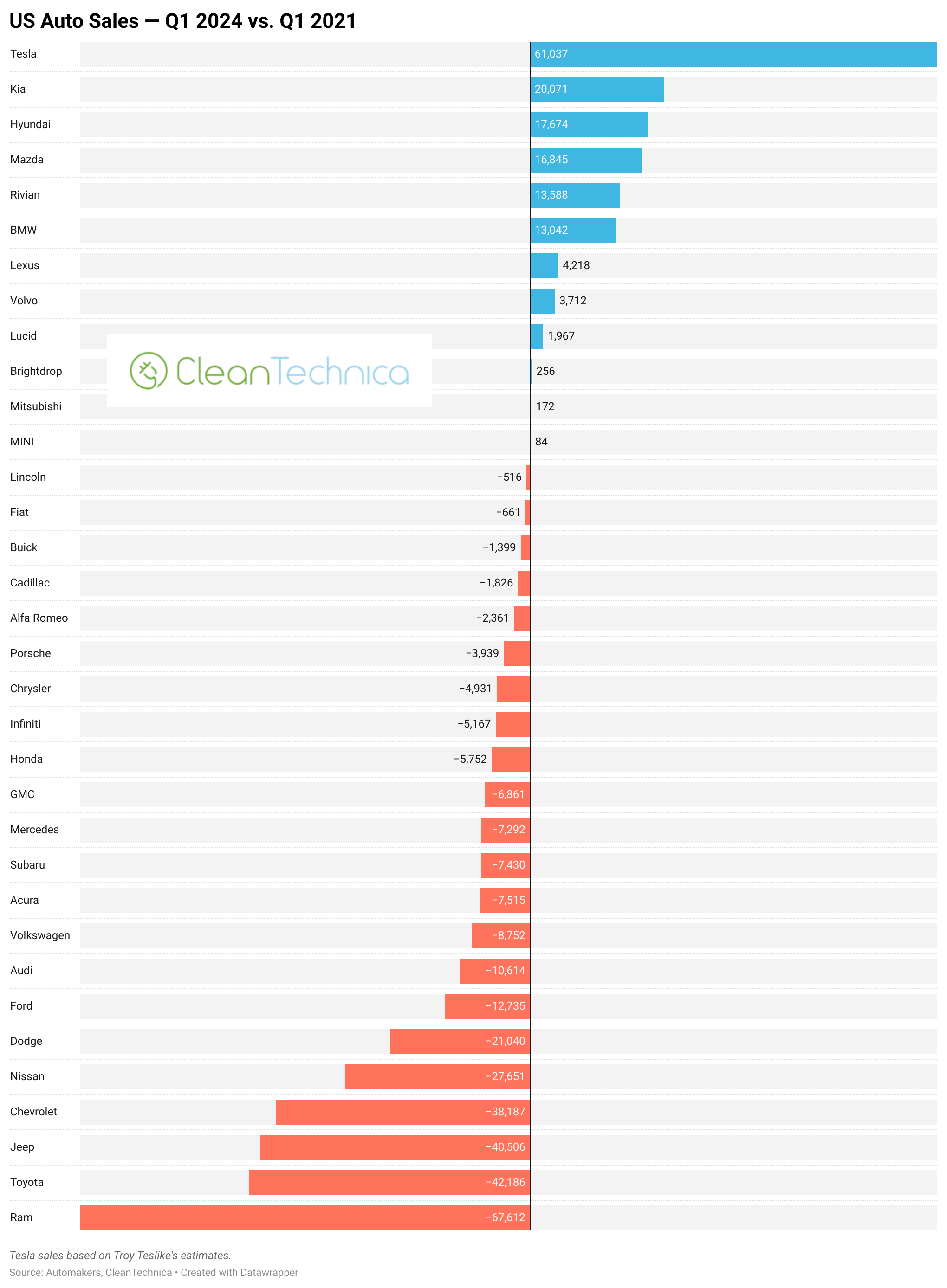

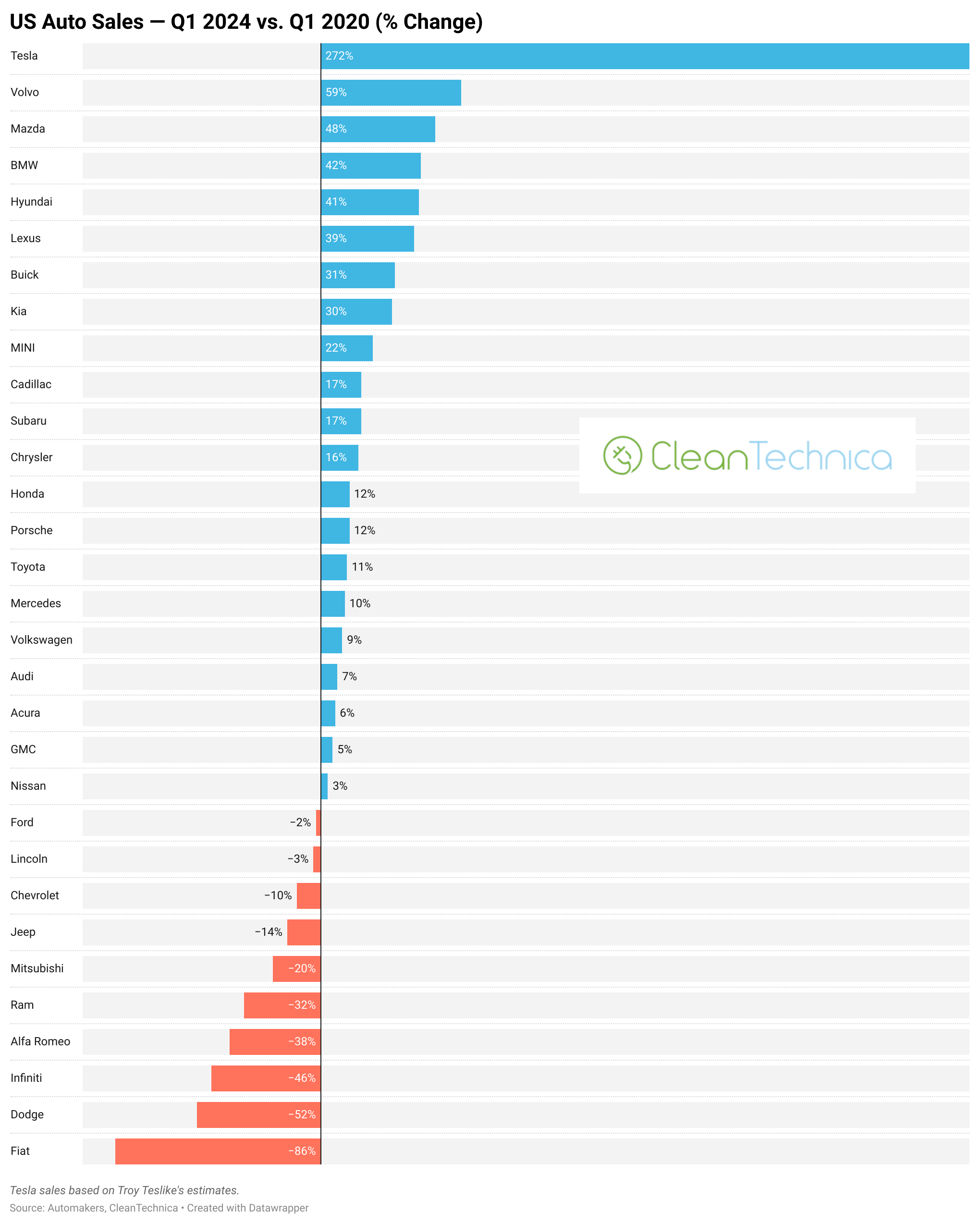

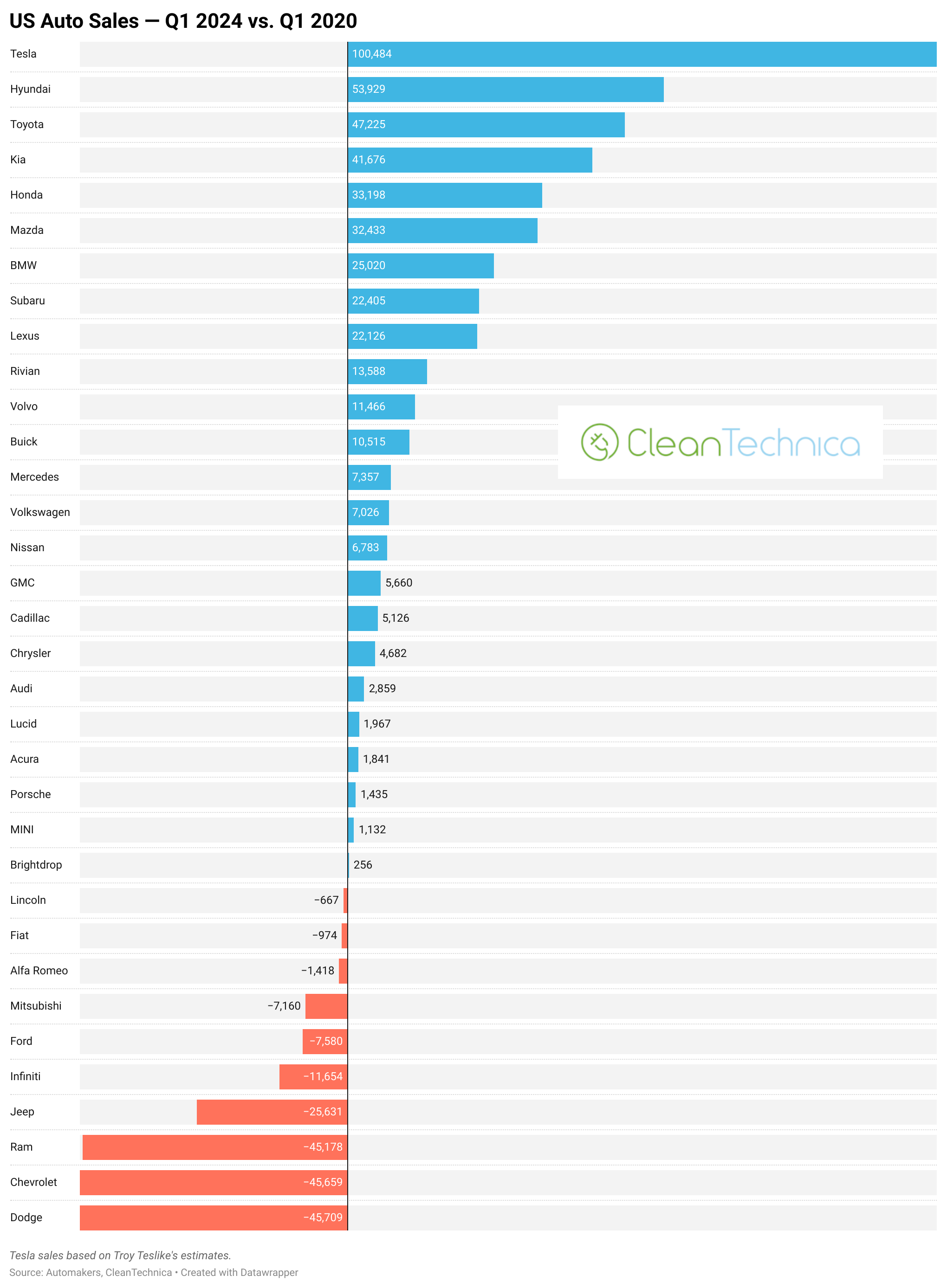

For the rest of this article, you can explore sales changes by auto brand in terms of percentage change or volume change in Q1 2024 versus Q1 2023, Q1 2024 versus Q1 2022, Q1 2024 versus Q1 2021, Q1 2024 versus Q1 2020, and Q1 2024 versus Q1 2019. I’m just going to dive into the comparisons to Q1 2023 and Q1 2019.

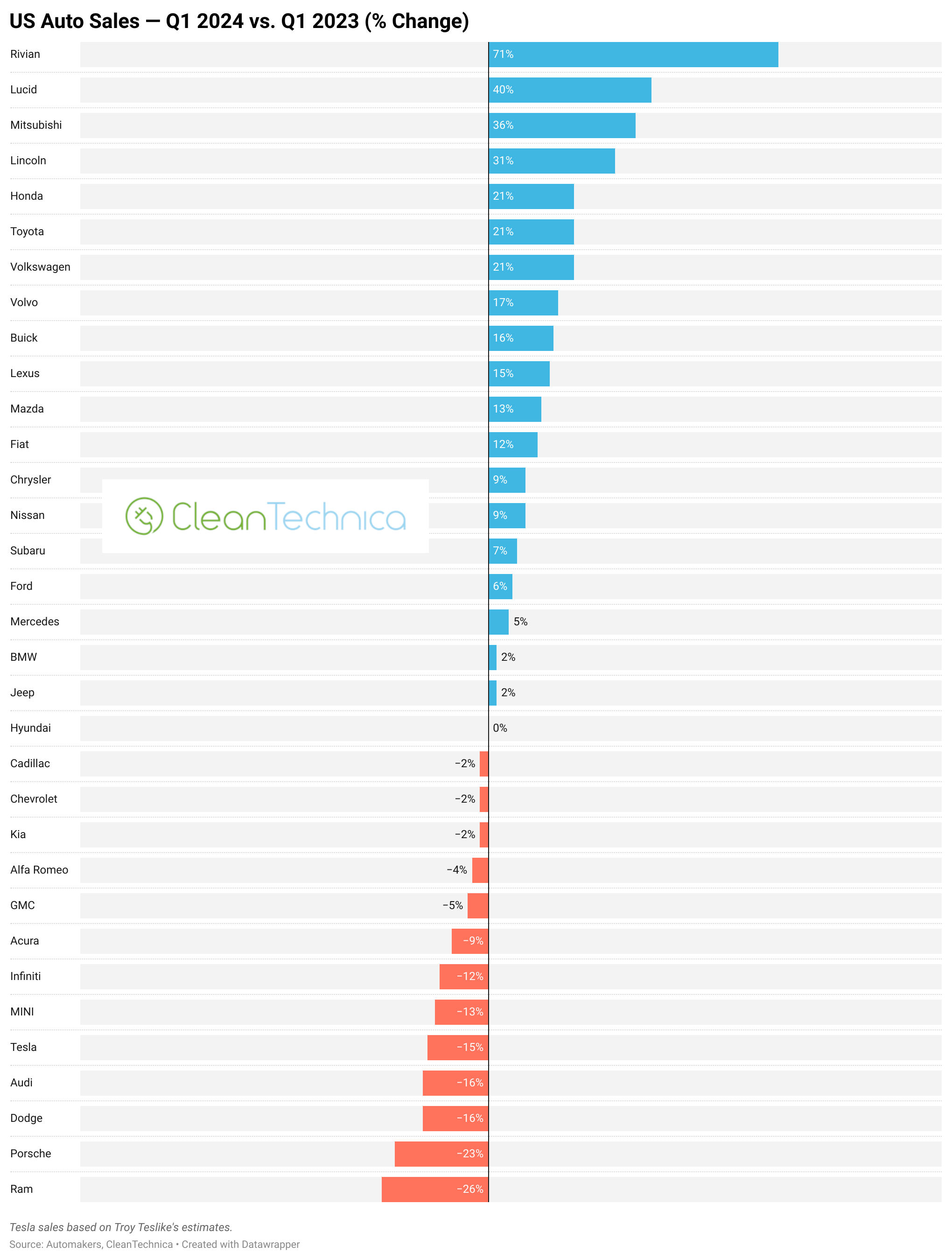

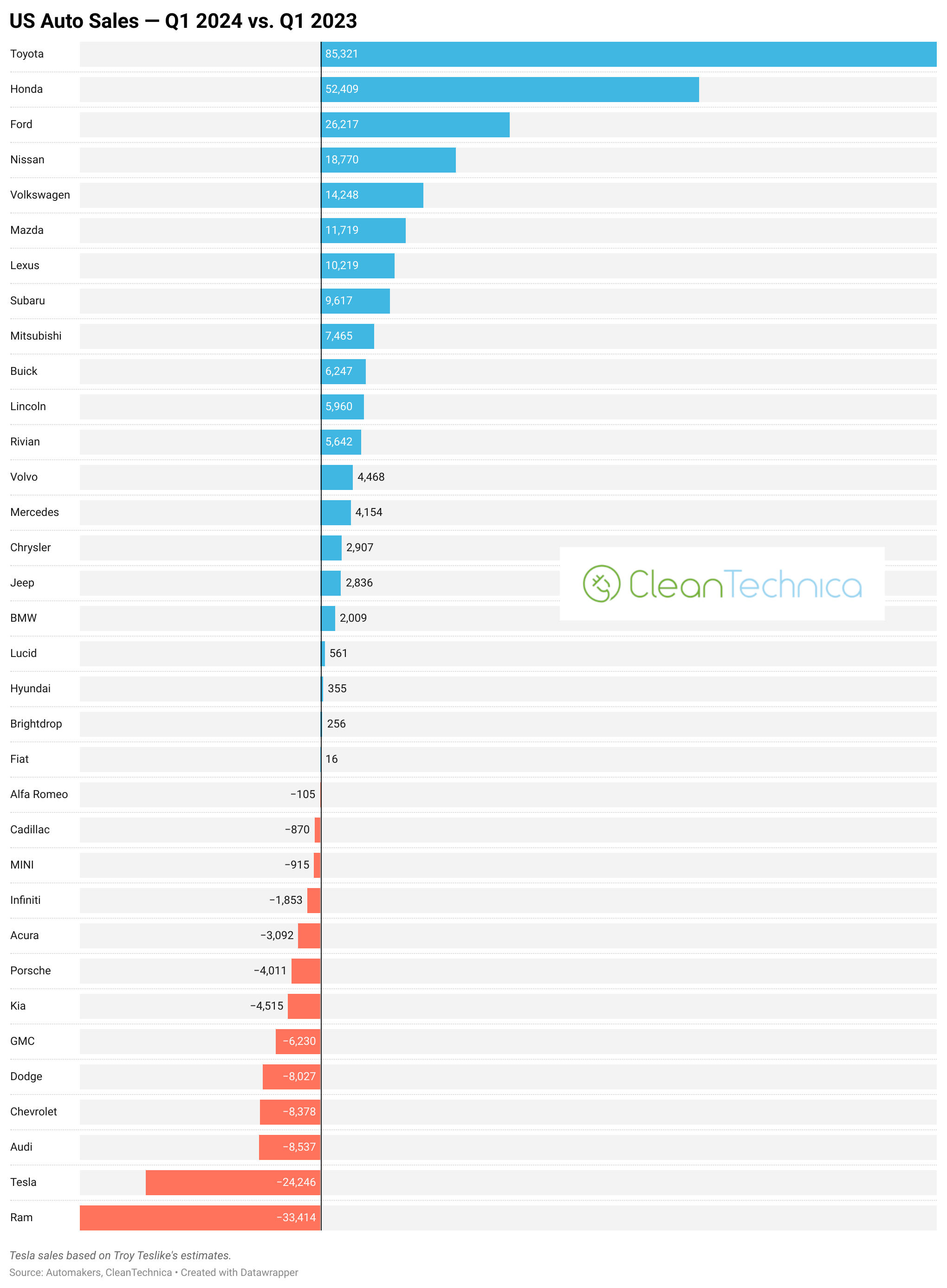

Clearly, Rivian and Lucid are up a lot this year compared to last year because they were starting from a low base last year (and, actually, are still at a low base). Most notable to me is that Toyota and Honda had big increases in sales after not doing very well for the past several years. Perhaps rumors of their death were exaggerated….

Oh, yes, the other big note: Tesla sales dropping by about 24,000 sales and 15%! That stings, including for the EV industry as whole, where many headlines about falling EV sales or EV sales growth try to generalize Tesla’s situation across the rest of the industry.

The one that really surprised me was RAM’s big drop in sales. With headlines abounding regarding the other companies noted above, I didn’t see anything on RAM and its continued struggles. Interesting…. We’ll have to see what happens with this big truck maker in coming quarters, especially as (or if) sales of the Tesla Cybertruck, Rivian R1T, Ford F-150 Lightning, and Chevy Silverado EV grow.

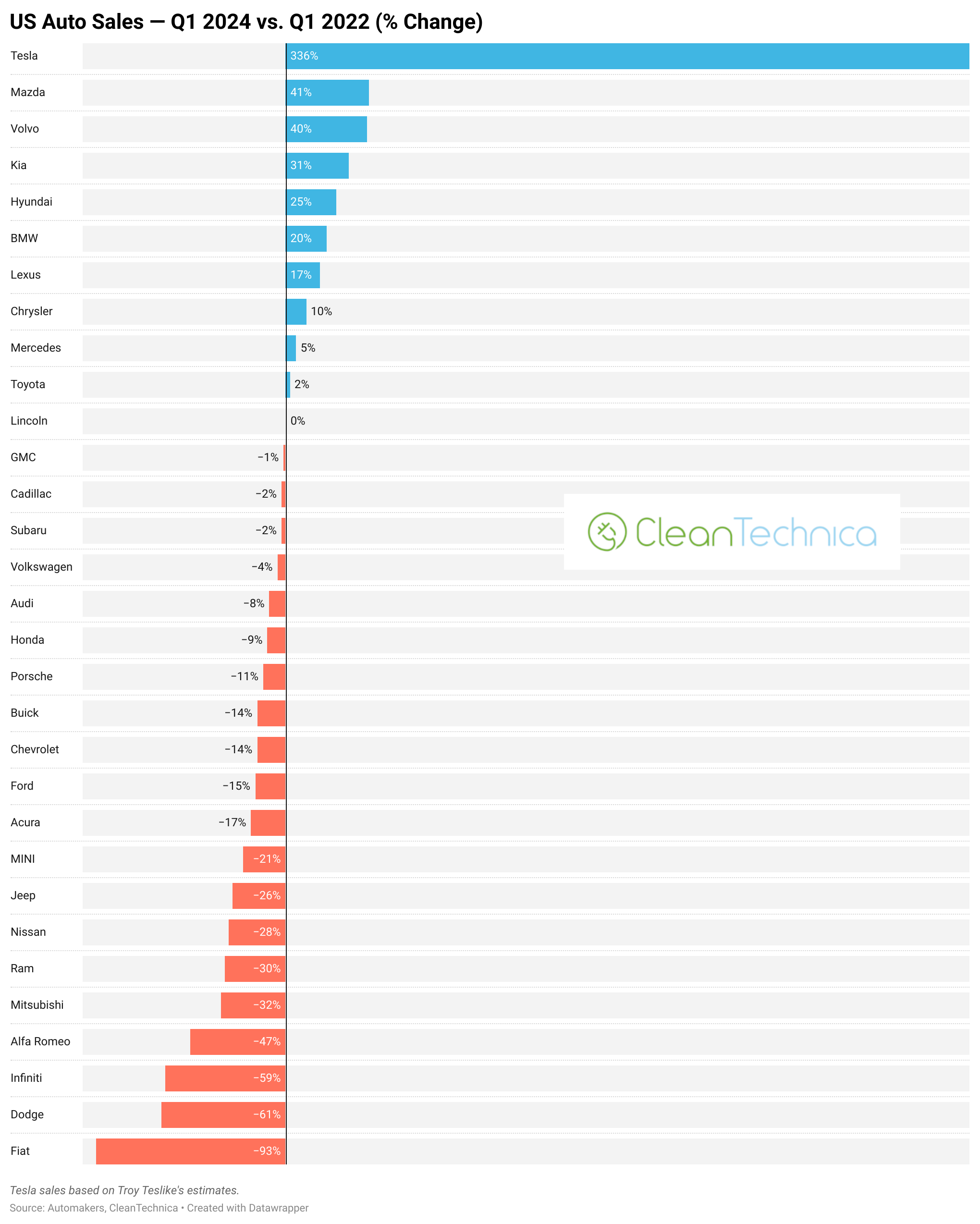

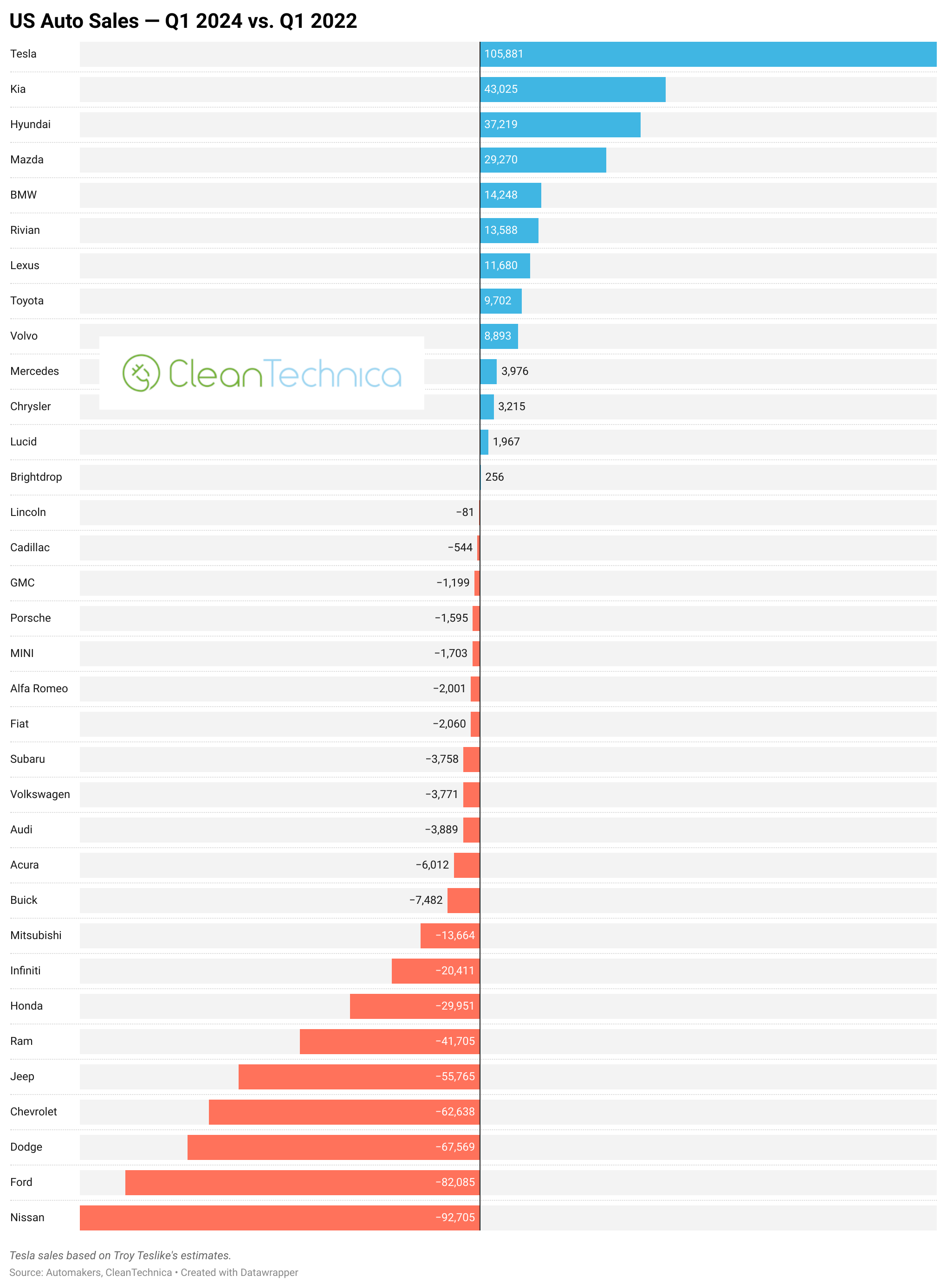

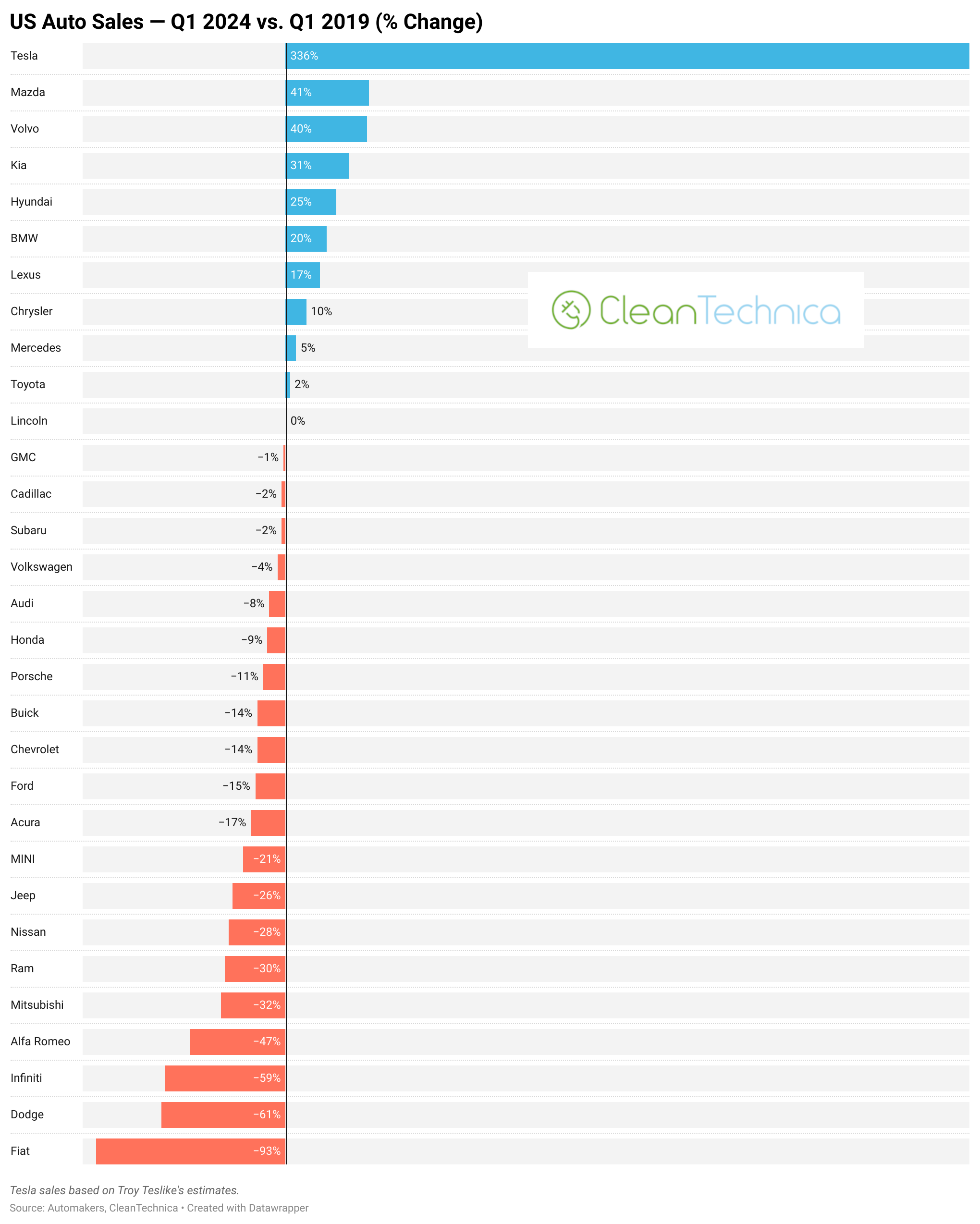

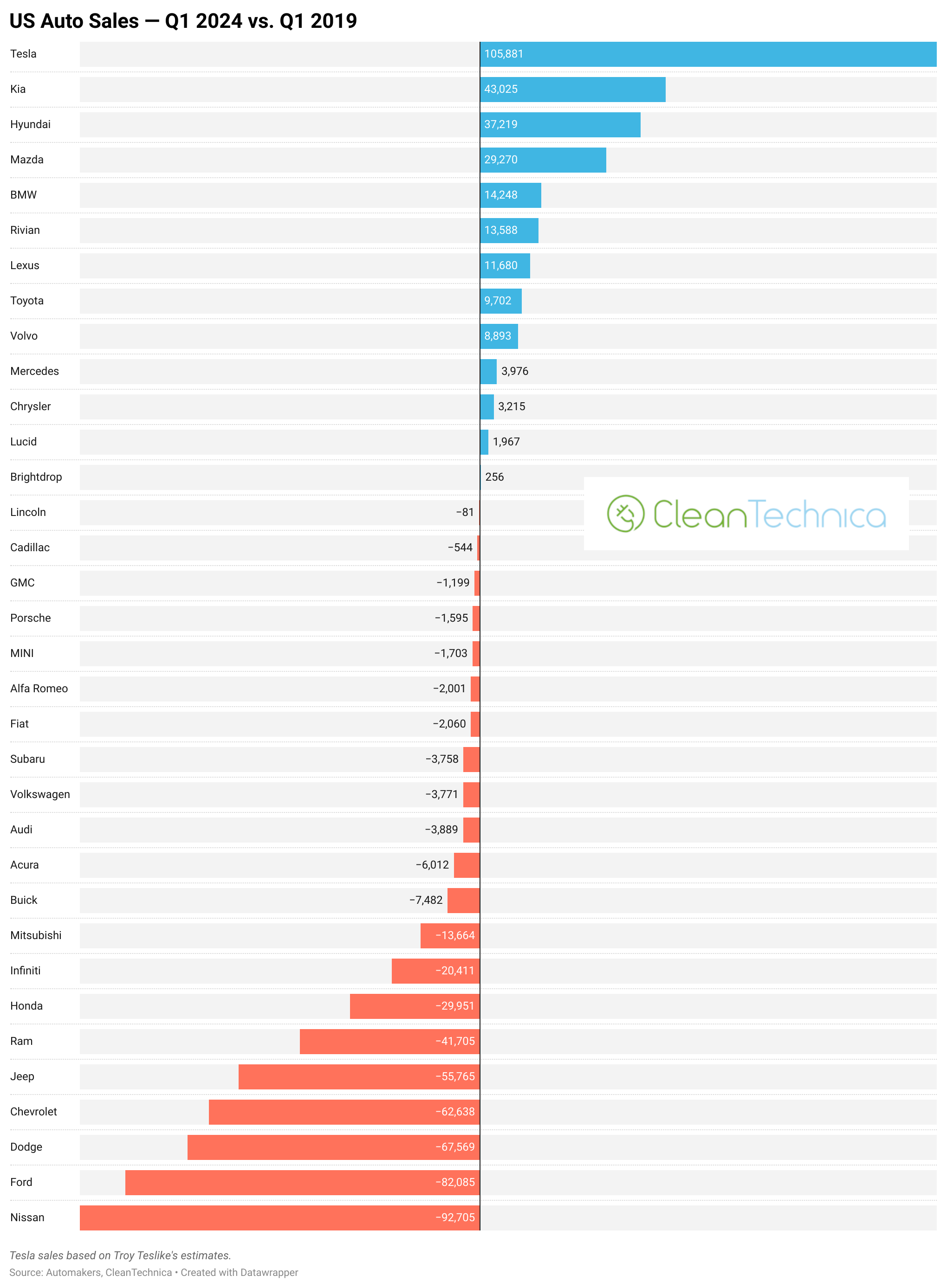

Looking back five years, things are much more interesting. Most notably, Tesla sales soared 336%, or by about 106,000 units. If there’s one clear winner in the “COVID era,” it’s Tesla. (Ironic, isn’t it?) Hyundai, Kia, and Mazda are other big climbers, growing by 25% (37,219 units), 31% (43,205 units), and 41% (29,270 units) respectively. Volvo Cars did particularly well on a percentage basis — up 40% — but was starting from a pretty small base, as indicated by its unit sales increase of just 8,893.

Aside from those clear winners, a handful of luxury brands were in the positive — BMW, Lexus, Chrysler, and Mercedes — and Toyota was actually up 2% despite some especially harsh drops in sales in some of the years in between. Skipping all those years in between, Toyota comes across as basically as stable as can be — or, well, I guess Lincoln holds that title, but Toyota at least had modest growth.

Overall, many auto brands saw lower sales in Q1 2024 than Q1 2019. The big dogs really losing a ton of sales volume wise, though, were Nissan, Ford, Dodge, Chevrolet, Jeep, and Ram. We’ll see what the coming quarters and years bring, but the story right now doesn’t look great for US-based auto companies (and Nissan).

As one final piece of this report, if you want to look at a massive master chart of Q1 US auto sales across these five years, here’s an interactive chart to explore (much better done on a computer rather than a phone):

Related reports:

Cadillac, Audi, & BMW Now Leading in Share of US Sales Being 100% Electric

US EV Sales Up 170% in 1st Quarter vs. 1st Quarter of 2021

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.