Critique of ARK Analysts’ Tesla Robotaxi Projections Misses Some Key Points, But ARK Might Too

Checking out the Friday critique of “Tesla’s $9 Trillion Robotaxi Dreams” on Seeking Alpha that Carolyn Fortuna just covered, a few things jumped out to me. A few things seem to be missed, misunderstood, or even misleading from the analysts. But, then again, that doesn’t mean the ARK analysis is right, and there are some assumptions in there that I find a little odd as well.

First of all, there’s the assumption that robotaxis will likely cost $150,000 to $200,000 each. The analyst linked to a blogspot article with this claim. That article got a NYTimes estimate of “as much as $200,000” for a Waymo robotaxi and a NYTimes estimate of $150,000 to $200,000 for a Cruise Chevy Bolt robotaxi. The Seeking Alpha article states, “Robotaxis will likely cost $150K to $200K each, and building a global fleet would cost over $35 trillion. Only Amazon and Alphabet’s Waymo have the necessary cash flow.”

This is all kinds of whack. Tesla is using a very different approach from Waymo and Cruise, and you can’t just assume their costs would be the same as Tesla’s. For that matter, you can’t even assume Waymo’s and Cruise’s costs would stay at that level in a mature robotaxi market. But just looking at Tesla, its Full Self Driving (FSD) system is supposed to work in a lowly Tesla Model 3 just as much as it’s supposed to work in some minibus designed for robotaxi service. My 2019 Tesla Model 3 is still supposed to have adequate hardware for Tesla’s FSD system. Tesla is selling the Model 3 for under $40,000 — or about $50,000 if you add FSD. If you are going to assume Tesla FSD will eventually be robotaxi capable, then I don’t see how you can assume a $150,000–200,000 cost for a Tesla robotaxi.

Of course, you can assume Tesla won’t succeed with robotaxi-capable FSD, but then there’s no point in doing such a long financial analysis and comparison in the first place.

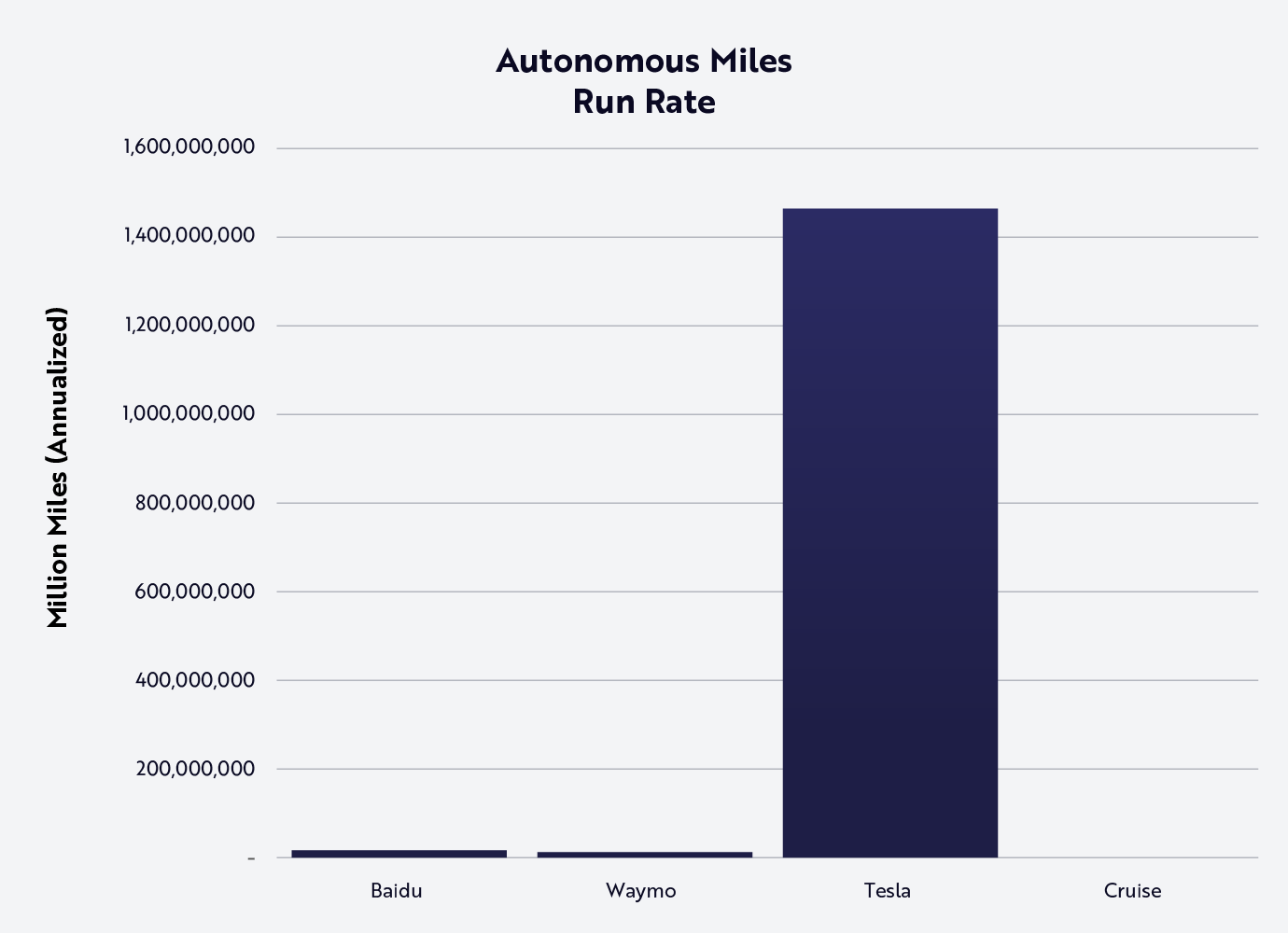

The second thing regarding the analysis: it’s assuming that Zoox and Waymo are on the same level as Tesla’s FSD and it’s just about how much money the companies have to pump into them and grow. It seems to assume they’d all reach broad robotaxi capability at the same time. As far as I’ve seen, seen, the three companies are not at all alike in their approach. (Though, I have to admit that I haven’t been following Zoox closely lately and don’t know what it’s been up to.) Just one short comparison highlighting the difference: Tesla’s FSD sensor suite and data collection is in millions of vehicles, whereas Waymo and Zoox have tiny fleets for testing in comparison. ARK itself highlights this clearly with a chart showing how many millions of autonomous miles each company is logging annually:

Well, there isn’t a chart there for Zoox, but if there was, you can imagine Zoox’s bar would be hard or impossible to see.

So, again, you can say that Alphabet and Amazon have a lot of money to put into robotaxis, but you can’t compare what all these companies are doing and just assume that they are all going to have geographically broad robotaxi capability at the same time.

It’s been clear for a long time that Tesla is pursuing a kind of “bet the house” approach on FSD with the expectation of winning much more than a house. The idea is that if FSD gets to robotaxi capability, those robotaxis will be available essentially everywhere. No other company is pursuing the same plan. So, Tesla really does seem to stand alone in what it can gain if everything goes right (eventually). The point is that it’s not spending $150,000–200,000 per vehicle and not rolling things out city by city.

Regarding licensing, which the analysis spends some time on and even says, “I don’t see Tesla getting $0.50 per mile in revenue from licenses. Because Waymo and Zoox are working on their software, their AI lead could very well ensure they cut Tesla out of the loop.” Huh? Again, if Tesla’s approach works, there won’t be any competitors for a while at least. Tesla will be able to charge whatever the buyer is willing to pay to license FSD, and there won’t be competition to create any kind of price war. Tesla, as a profitable company, will have the upper hand in negotiations. It’ll just be a matter of how much worth FSD has to a buyer and what they can pay for it.

So, overall, I find this financial critique quite off base and resting on some wild assumptions.

However, that’s not to say ARK Invest has nailed it. Again, it’s still a question of whether Tesla FSD gets good enough to be approved for unsupervised self-driving and robotaxi capability. Some people (like Elon Musk and Cathie Wood) seem to think they know that this will happen. Others in the field seem to think they know it won’t. But one thing I don’t like about ARK’s analysis is that it seems to be detached from reality and good logic at times itself as well.

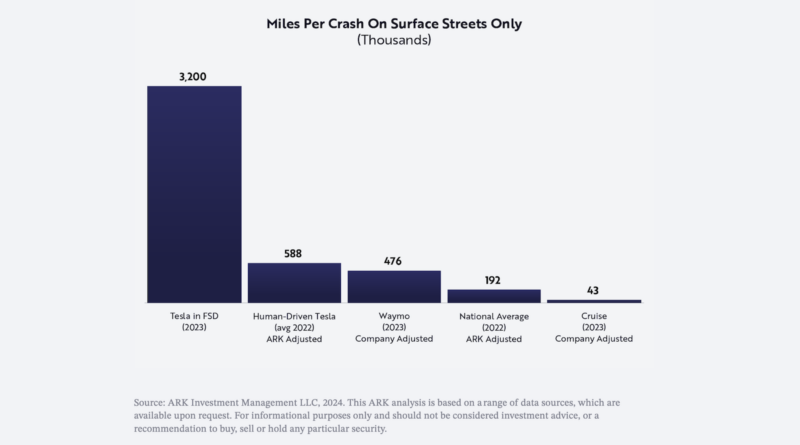

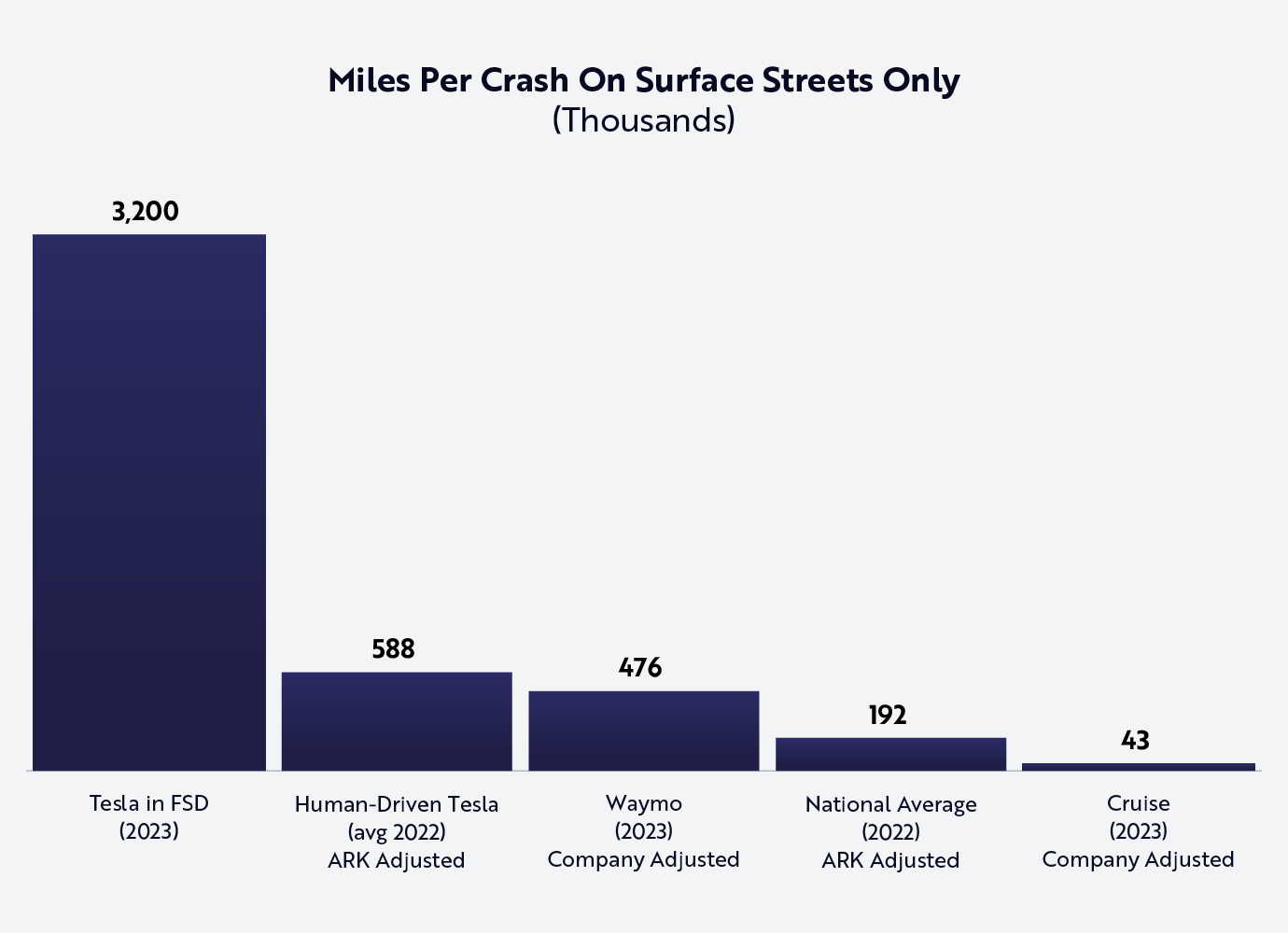

“Furthermore, our research suggests that a Tesla in FSD mode is ~5X safer than a human-driven Tesla, as shown below, and ~16X safer than the average car on the road, also shown below,” the company writes. Here’s the chart it’s referencing:

This is not a valid or useful comparison. Tesla in FSD is operated by a human. It’s not FSD’s crash rate. It’s the crash rate of people closely monitoring FSD who paid thousands of dollars for it, who have probably invested in TSLA, and who are constantly being asked or triggered to move the steering wheel or intervene. I have FSD and have used it for years. There’s no way that if I had let FSD do whatever it wanted all the time, I wouldn’t have ended up in accidents. So, I think it’s either disingenuous or idiotic to include a comparison of drivers using FSD to an actual Waymo robotaxi and assume it means anything about FSD capability.

ARK Invest goes on: “No longer constrained by AI training compute,7 Tesla’s accelerated software updates are enhancing performance and safety.8 As a result, Tesla should be able to demonstrate superior, statistically significant safety metrics and receive regulatory approval for its robotaxi network.”

Again, that’s just jumping to conclusions. Tesla FSD has gotten better, indeed, but assuming it’s going to get approved for robotaxi service is a big assumption, and the logic backing up that assumption doesn’t seem adequate enough for me. Maybe it will, maybe it won’t, but this is something Tesla’s Elon Musk has been saying is coming soon for almost a decade. Will all of the “little things” get fixed by neural nets and lead to regulatory approval? Or will the see-saw problem plague Tesla for years to come? Who knows?

Overall, though, you either believe in Tesla’s approach or you don’t. It’s not a case of Tesla, Amazon, and Alphabet being on the same track. It’s almost like they are playing different sports. Trying to shove some kind of financial analysis comparison into the discussion is pointless, in my humble opinion. Either Tesla’s approach works and its a vastly better, cheaper, more geographically broad robotaxi system, or it doesn’t and the company’s stock is massively overpriced for its automotive sales business. As Elon Musk has said, you either believe in Tesla’s approach to AI, robotics, and FSD, or you shouldn’t be invested in Tesla. End of story.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.