47% of New Cars Sold in Netherlands in 2024 Have a Plug!

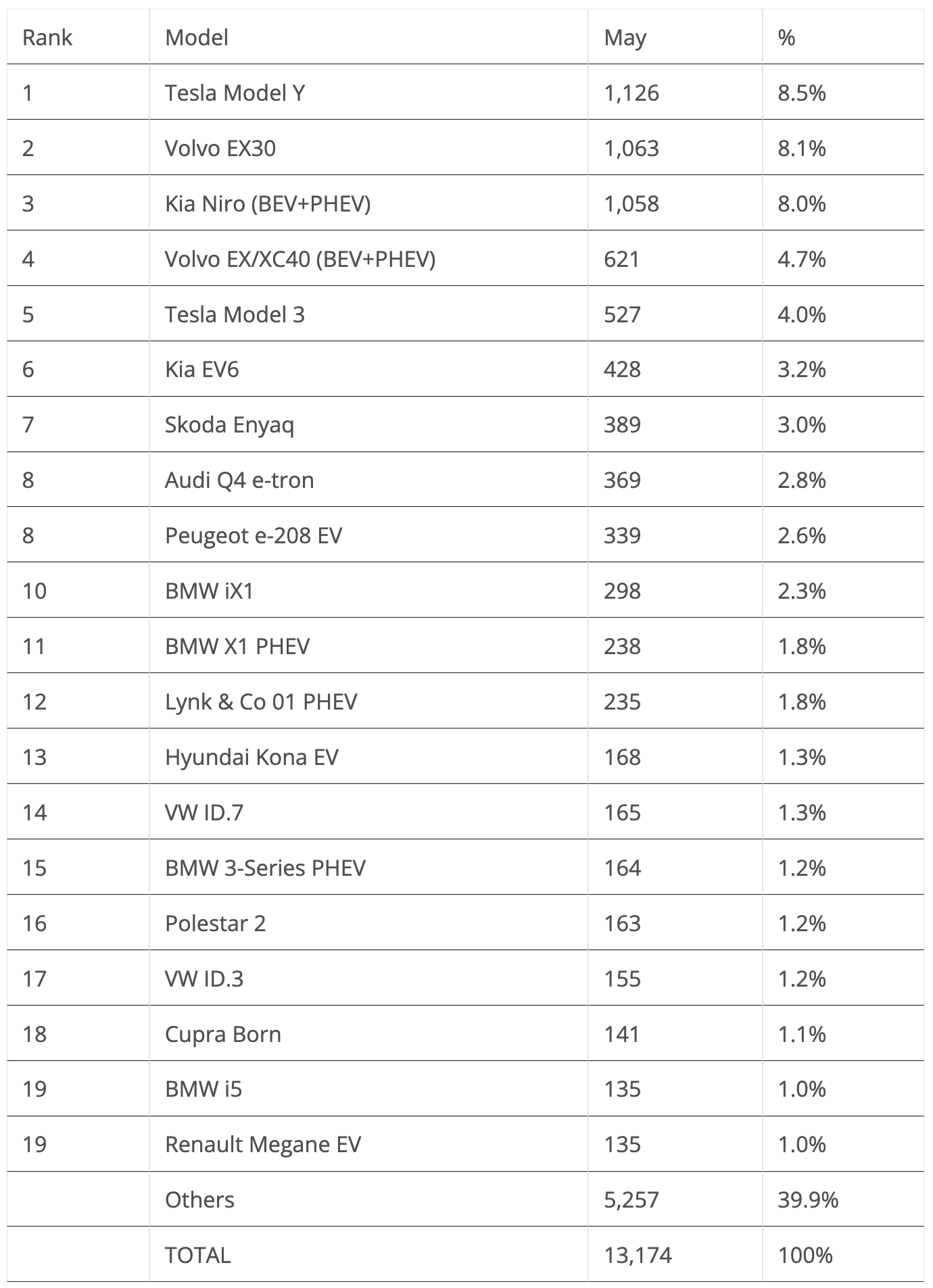

In a negative month in the overall market (down 14% to 28,361 units), May saw plugin registrations also drop by 13% YoY, to 13,174 units. As a result, the Dutch plugin vehicle (PEV) market reached 47% last month, in line with the year-to-date average. That’s mostly thanks to pure electrics (34% of new vehicle sales). With 9,680 registrations, pure electrics (BEVs) represented 74% of all plugin sales last month, above the YTD average of 68%.

Comparing the current results with 2023, we are already above the full year score (44% PEV, 31% BEV), and more importantly, a full 7% above the results presented 12 months ago. This points to the possibility that the Dutch EV market could cross the 50% mark already this year and finish the year at around 51% share, with BEVs at 36%! That would be some good news! (Now, how the new EU tariffs on Chinese EVs will impact this market remains to be seen. More on this at the end of the article.)

At this pace, the Dutch market could reach some 80% plugin share by 2028, and around 90% by 2030, which is not bad at all….

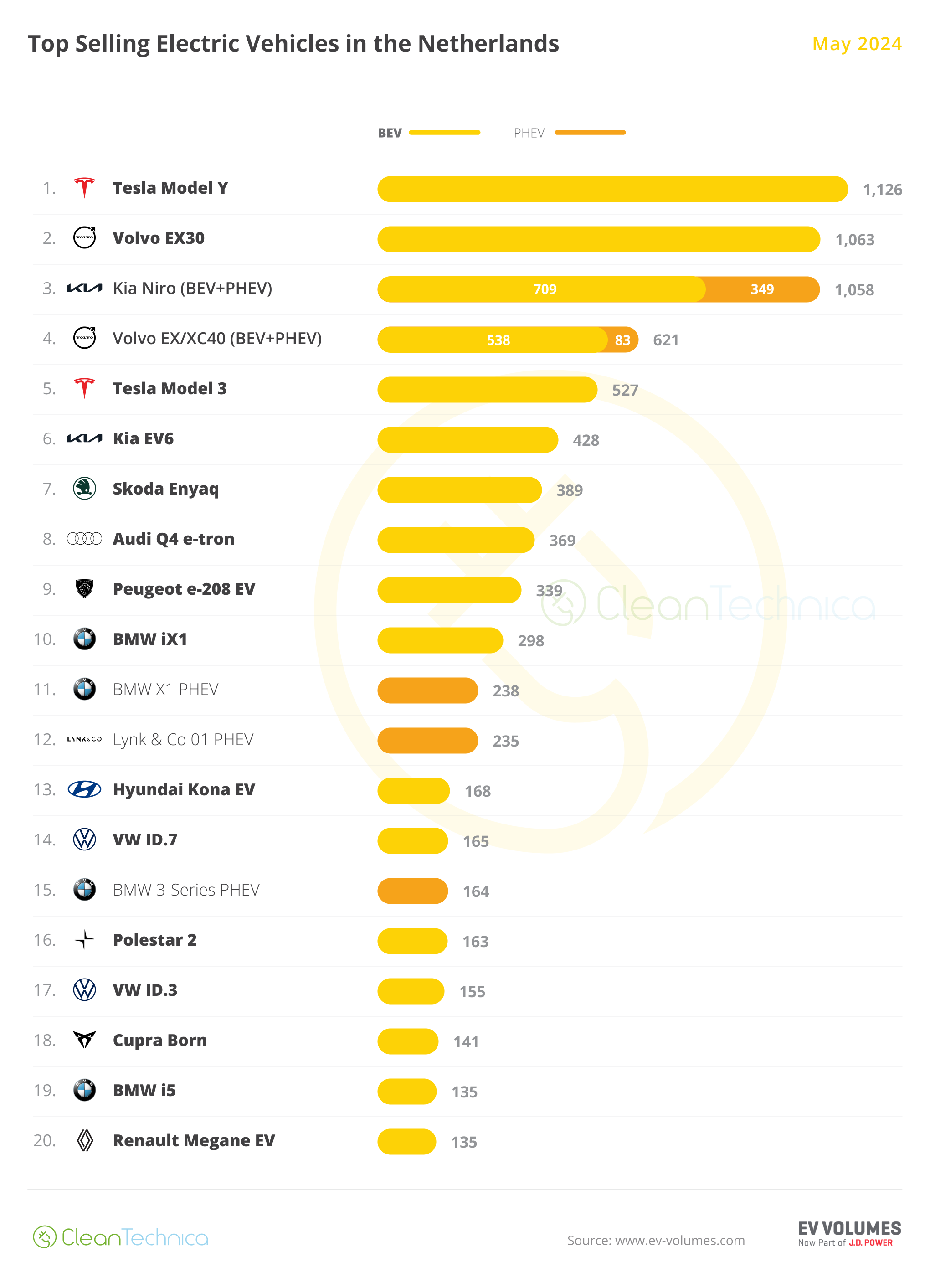

In May, the Tesla Model Y narrowly beat the Volvo EX30, with 1,126 sales vs. 1,063 sales, allowing the US crossover to recover the #1 spot.

Elsewhere, the Kia Niro was 3rd, with 1,058 registrations, 709 of them belonging to the BEV version, followed by the Volvo EX/XC40 SUV, in 4th with 621 registrations, of which 538 were BEVs. Then, the Tesla Model 3 was in 5th.

Looking at the overall auto sales table, the Kia Niro took profit from the additional units coming from the HEV version to take first place with 1,414 registrations, leaving the runner-up spot to the Tesla Model Y. It was thus a full 100% plugin podium in the Netherlands. This is another sign that the merge between the plugin and overall markets continues.

The 4th placed Volvo EX/XC40 is also heavily electrified, as 72% of all its sales belong to the BEV and PHEV versions. The best selling pure ICE model in the overall ranking was only 5th, with the little Kia Picanto winning that title. (We really need small, cheap EVs….)

Back to plugins, and looking beyond the top sellers, we should highlight the performances of the Kia EV6, 6th with 428 registrations, its best score since December 2021; and the 8th placed Audi Q4 e-tron, which had its best score in 14 months, 369 registrations.

Speaking of Volkswagen Group, it had its best month in a long time, placing five models in May’s top 20. It was the OEM with the most representatives on the table, with the highlight being the VW ID.7(!) showing up on the best sellers table for the first time with a record 165 registrations.

In the PHEV category, this time the best selling model was the BMW X1 PHEV. With 238 registrations, it ended in #11, beating the Lynk & Co 01 PHEV in this race by just three units.

Elsewhere in the second half of the table, one highlight is the record performance of the BMW i5 (19th, 135 registrations). Not only has the big sedan beaten the remaining full size competition, but it has also beaten its smaller and cheaper sibling, the i4, which registered 112 units in the same period.

It seems the Audi Q8 e-tron domination of the full size category is coming to an end, as the attractive looking BMW (it is something of a rarity to have these three words together these days…) seems poised to replace it, in no small part thanks to the addition of a station wagon body. (Mercedes, take note….)

Outside the top 20, the Kia EV9 continues to impress, thanks to 109 registrations in May. The BYD Atto 3 continues near the top 20 zone, thanks to 126 deliveries, all while three new EVs land with positive numbers: The crossover Renault Scenic EV landed with 115 units already, so we might see it inside the best sellers table soon, while its French arch-rival, the Peugeot e-3008 EV, also landed in May, albeit with less of an impact, having registered just 70 units. Finally, Mini’s Countryman EV had its first full month on the market, with 101 registrations, pushing the British make’s numbers upwards.

Interestingly enough, all these three new models are compact crossovers, which says a lot about where the market is right now….

Speaking of compact crossovers, in the Volkswagen stable, the #21 ID.4 registered 130 units, ending the month just five units behind the BMW i5 and Renault Megane EV, both tied in #19. That could mean that the German EV could be close to returning to the best sellers table after a slow start of the year.

And it serves as another indication that Volkswagen Group is returning to form.

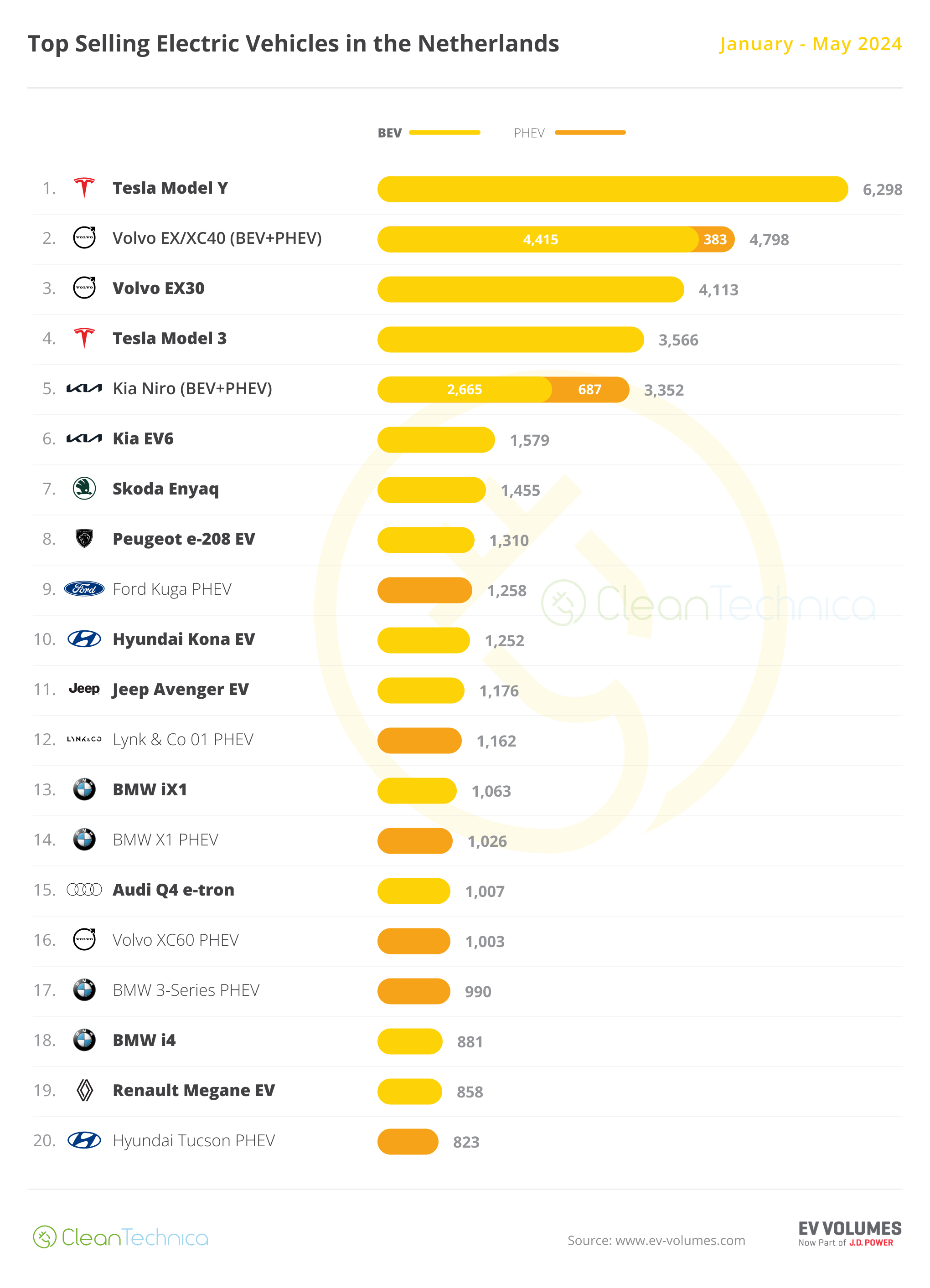

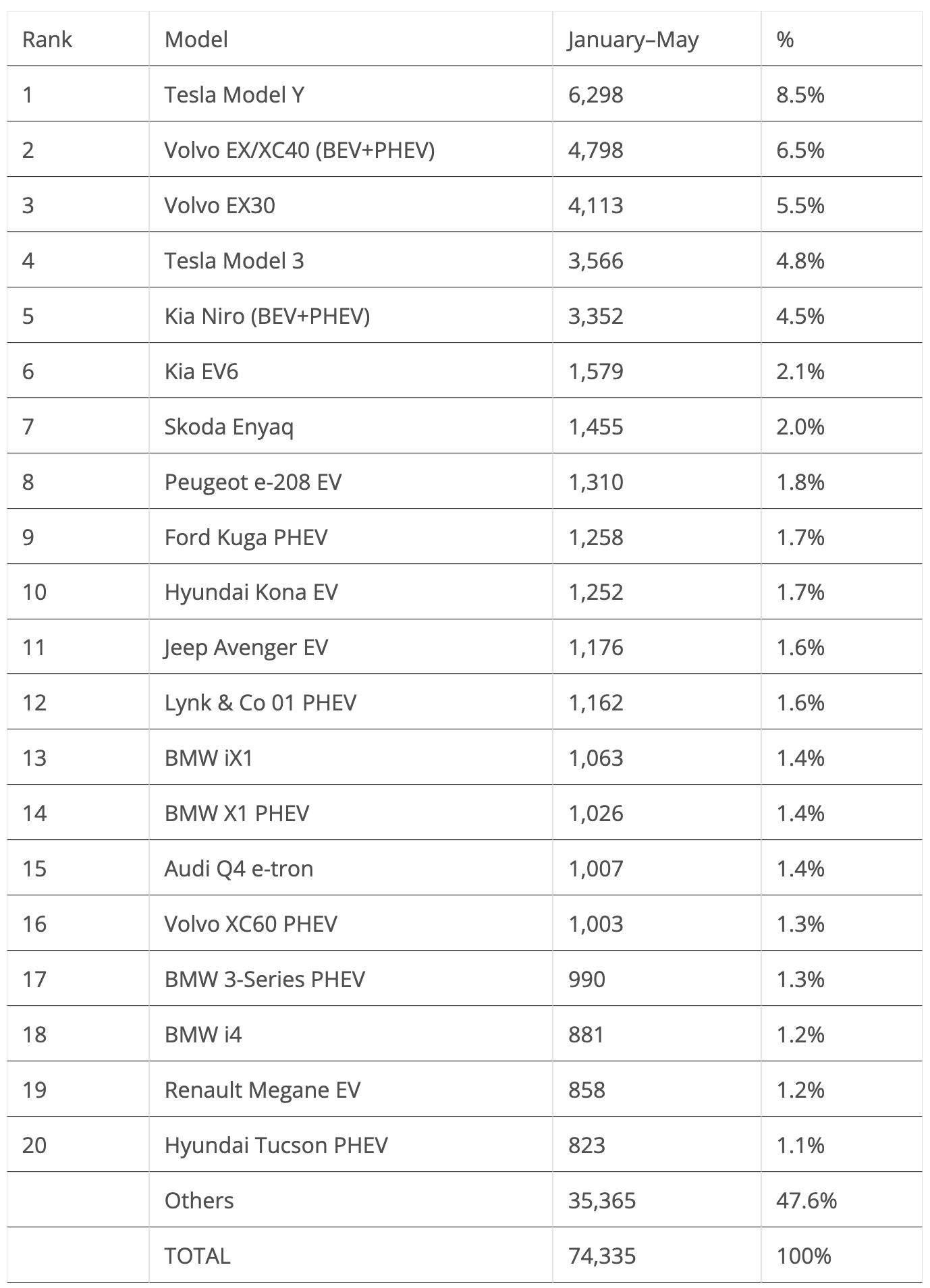

Looking at the 2024 ranking, the Tesla Model Y has exactly 1,500 units of advance over the runner-up Volvo EX/XC40, which should be enough to remain comfortable in the lead.

With the runner-up EX/XC40 showing its wrinkles (it has been on the market since 2017), and threatened from within with its younger sibling EX30, the Belgian-built Swede does not seem to have enough pace to go after the Model Y.

As for the rising star Volvo EX30, now in 3rd, the future tariffs will likely damage the Made-in-China model’s career. So, while surpassing its older sibling and winning the silver medal seems possible, it will be nearly impossible to reach the Model Y’s tail lights.

It’s the same story for the Tesla Model 3. While it is now 4th, the new tariffs will probably hurt the sedan’s performance, allowing the #5 Kia Niro to surpass it during the second half of the year.

The top five models are significantly above the remaining competition, but a lot has happened below the top sellers.

The Kia EV6 was up one spot, to 6th, while the Skoda Enyaq jumped two spots, to 7th.

In the second half of the table, the BMW iX1 was up to 13th, while the Audi Q4 e-tron replaced its Q8 stablemate in the top 20 by joining the best sellers table in #15.

Finally, note that there are just three Made-in-China models in this top 20, the #3 Volvo EX30, the #5 Tesla Model 3, and the #12 Lynk & Co 01. So, unlike other markets, do not expect major shifts in this particular market. Besides the aforementioned slowdown in the sales of the Volvo EX30 and Tesla Model 3, expect the Lynk & Co model to also suffer, possibly ending the year outside the top 20.

Although … this is assuming that the OEMs won’t be able to sustain the tariff increase and will pass along to the buyer the 20% extra cost (around 8,000 euros per unit), thus making them far less competitive.

Because, as some have already mentioned, it could be the case that the OEM margins are big enough to accommodate the tariff increases without increasing the final price to consumers.

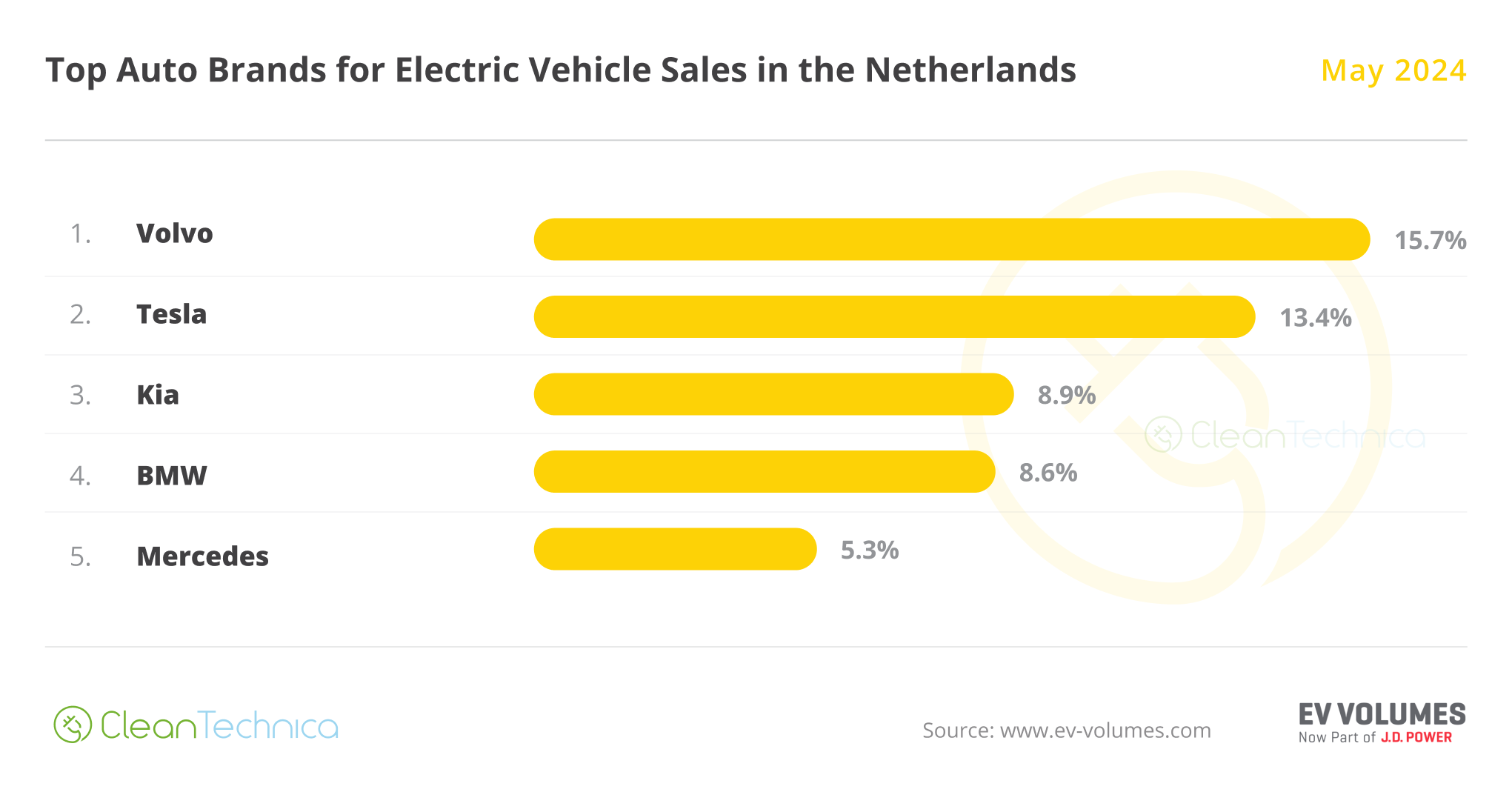

In the manufacturer ranking, there was no major news. Leader Volvo continued to rise, now at 15.7%, up 0.1% from April, while runner-up Tesla is at 13.4%, down 0.1% from the previous month. Expect both to lose some share in the second half of the year, due to the tariff increase.

Meanwhile, #3 Kia (8.9%, down from 9.1%) and #4 BMW (8.7%) held steady, with both future performances unaffected by the EU–China EV spat.

Finally, in 5th, we have a falling Mercedes (5.3% share, down 0.1%), which hasn’t managed to place any model in April’s top 20. It’s likely that rising Volkswagen, now 6th, will surpass Mercedes soon.

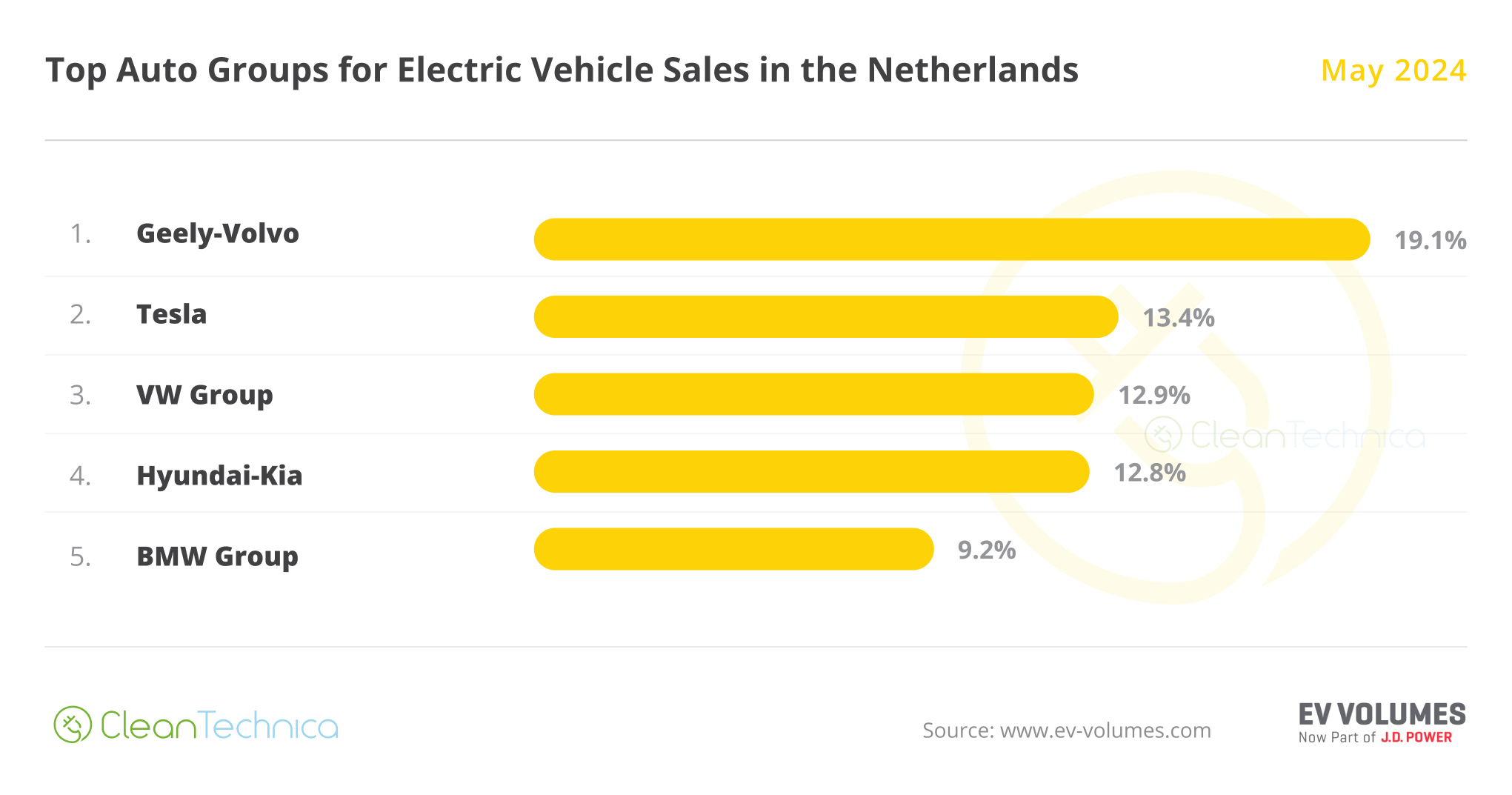

As for OEMs, the leader, Geely–Volvo, is at 19.1% share, which is more or less the same it had in the previous month (19.2%). But with Polestar, Lynk & Co, and the Volvo EX30 being hurt by the tariff increase, expect Geely to lose some share in the second half of the year.

Tesla is second, with 13.4% share, but a strong Volkswagen Group (12.9%) is right behind. The German OEM rose to 3rd in May, and is unaffected by the Made-in-China tariff increase. Expect the German OEM to reach silver sometime during the second half of the year.

As for Hyundai–Kia (12.8%), despite losing one position, the Korean OEM could profit from Tesla’s expected tariff-induced lower sales in the second half of the year to also surpass Tesla and secure the last position on the podium.

BMW Group (9.2%, up 0.2%) is 5th, leaving Stellantis in 6th, with 8.2% share.

While the BMW brand might not be much affected by the increased tariffs — after all, the iX3 was never a big seller in Dutch lands — the Mini brand will be heavily impacted, as all of its EVs are now coming from China. As such, the German OEM will not see growth coming from the Mini brand, which might prevent it from resisting an expected resurgence from Stellantis in the second half of the year.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.