Texas Finally Finds A Reason To Love BlackRock, Renewable Energy And All

Republican officeholders in Texas have spent the past three years or so bashing the A-list financial firm BlackRock on account of the company’s support for renewable energy. Well, that was then. BlackRock has suddenly emerged as one of the key funders of the proposed new TXSE national stock exchange headquartered in Dallas, with some interesting implications for renewable energy investing throughout Texas and the entire Southeast.

Suddenly, Hearts & Flowers For BlackRock (But Not Renewable Energy)

Before we get to story behind renewable energy and the BlackRock-bashing, let’s take a look at the TXSE proposal.

As scooped earlier this week by The Wall Street Journal, TXSE is headquartered in Dallas, pending registration with the US Securities and Exchange Commission. If all goes according to plan, the aim is to begin trading in 2025 and commence listings in 2026.

In a press release dated June 5, TXSE’s parent company TXSE Group Inc. stated that it will “focus on enabling U.S. and global companies to access U.S. equity capital markets and will provide a venue to trade and list public companies and the growing universe of exchange-traded products.”

TXSE Group notes that more than two dozen investors were involved in raising initial capital, “including some of the largest financial institutions and liquidity providers in the world.” The firm cited two specific examples, BlackRock and the firm Citadel Capital.

Really, Really Not Renewable Energy

This latest news about BlackRock and Texas is more than a little weird, considering that it follows on the heels of a 2021 Texas state law aimed at protecting oil and gas stakeholders from “discrimination” by BlackRock and other financial firms that are transitioning into renewable energy.

The purported goal of the legislation is to protect the public from financial risk related to renewable energy and other elements of “ESG” investing. However, the law of unintended consequences is also hard at work, with local governments losing millions on bond sales attributed since 2021 (for details, check out our ESG coverage and this handy ESG explainer from the Austin American-Statesman).

Two dozen or so other states have adopted similar measures along with follow-on legal action since 2021, and Texas has doubled down on its pursuit of BlackRock.

Though BlackRock has a mixed record on the energy transition, the high-profile firm also emphasizes that climate change is a significant risk, reflecting the company’s footprint in the sustainability funds area. That has made it the chief target of officials in Texas and other states who support anti-ESG legislation.

In the most recent news on that score, news dropped barely three months ago that Texas has booted BlackRock out of the $8.5 billion Texas Permanent School Fund.

So, What’s Really Up With The TXSE?

What, indeed? Why all the sudden hearts and flowers for BlackRock?

Aside from legislation applying to certain areas like ESG and abortion access, Texas lawmakers have acquired a broad reputation for deregulating anything that is possible to deregulate. That partly explains the attraction of setting up a new stock exchange there, if you are someone who favors deregulation, but it doesn’t explain the new love affair with BlackRock.

To make things even a little more interesting, TXSE is not just for Texas. The goal is to establish a regional stock exchange for the Old South, or “southeast quadrant of the U.S.,” as TXSE prefers to call the US states that attempted to secede from the Union, with lethal results.

TXSE lists Texas, Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, and Tennessee within the its purview (Virginia and Arkansas also tried to secede but are not include in TXSE’s list).

And, that’s where things get even a little more interesting. Although most of the Southeastern states are represented in the anti-ESG movement, the region has also become a hotbed of investment in electric vehicle and EV battery manufacturing, among other elements of the renewable energy transition, partly due to “right-to-work” laws that have created a compliant pool of lower-wage labor. The 2022 Inflation Reduction Act also favors investment in Texas and several other Southeast states.

The Renewable Energy Juggernaut Just Keeps Rolling Along

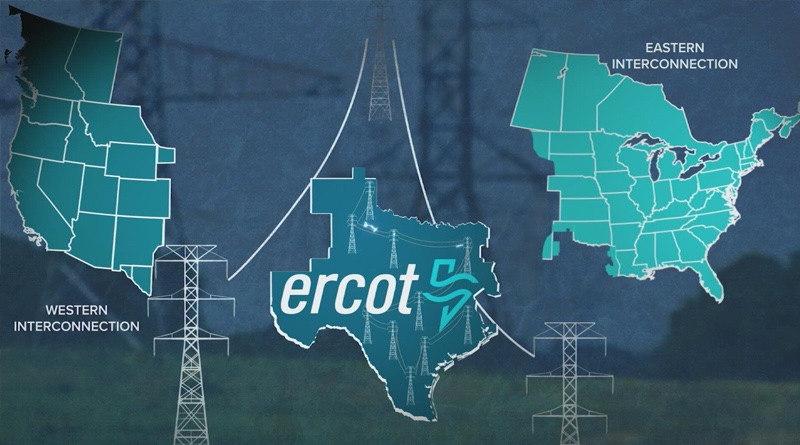

Meanwhile, the media chatter over TXSE has prompted comparisons with the state’s grid manager ERCOT, the Electric Reliability Council of Texas. Unlike other parts of the US grid, ERCOT is untouched by federal rules that regulate interstate electricity, the result of a conscious decision by state lawmakers to avoid federal regulation.

Federally regulated states can shift kilowatts around with their neighbors to balance the regional grid or respond to emergencies. But, not Texas. The Texas grid is almost entirely insulated from outside help.

With predictable consequences such as the notorious blackout of 2021 in mind, concerns have been raised over the ability of a Texas-based stock exchange to protect investors from fraud or rampant speculation, or both.

That remains to be seen. If you have any thoughts about that, drop us a note in the comment thread.

On the plus side, the comparison between TXSE and ERCOT is not all bad news. The “island effect” has motivated ERCOT to soak up every available in-state power generation resource. That includes an ever-growing stockpile of wind farms and solar arrays, on through a beehive of activity in e-fuels, green hydrogen, solid-state EV batteries, supercritical CO2, long duration energy storage, and other up-and-coming fields (see lots more stories here).

Oh the irony, it burns. Texas Governor Greg Abbott has made political hay by targeting BlackRock and other ESG-friendly financial firms for legislative attacks, but it seems that’s all for show.

TXSE Group Chairman and CEO James Lee hinted as much in an interview with the Dallas Morning News earlier this week. Lee told the Morning News that he “gives a lot of credit for the planned launch to Texas Governor Greg Abbott, who’s long supported such an endeavor,” as described by the business news publication Dallas Innovates.

So much for protecting fossil energy stakeholders. Between Texas and the Southeast states under the TXSE umbrella, CleanTechnica will expect a fresh torrent of renewable energy investing to rain down upon a region that is already benefiting from the combination of cheap labor, the IRA, and other Biden administration policies aimed at on-shoring the clean tech industry.

As for the Texas grid, keep an eye on a big play from the long distance transmission stakeholder Pattern Energy, which is laying plans to connect ERCOT and its copious wind and energy resources with neighboring Mississippi and Louisiana.

Follow me @tinamcasey on Bluesky, Threads, Instagram, and LinkedIn.

Image (screenshot): Plans are under way to connect the ERCOT grid in Texas with Louisiana and Mississippi (courtesy of Pattern Energy).

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.