Tesla, Toyota, or Hyundai — Who Wore It Best? A 1st Quarter US Sales Analysis

In this article, I analyze the Q1 sales results of three leading automakers and try to make sense of why the EV laggards did the best.

I’m going to discuss the electrification strategy of three of the brands in the US market and how it worked for them in the 1st quarter of 2024. My expectation a year ago was that Tesla would be selling many more cars, Hyundai would be doing okay, and Toyota would be struggling as the public realized they had missed their chance to be a leader in creating great electric vehicles. It looks like I (and many others) got it 100% wrong, in the short term at least. First, I’ll cover what each of those companies reported, then I’ll describe what worked and what didn’t, and then I’ll discuss where they (and other companies) will go from here.

Tesla Had A Tough First Quarter

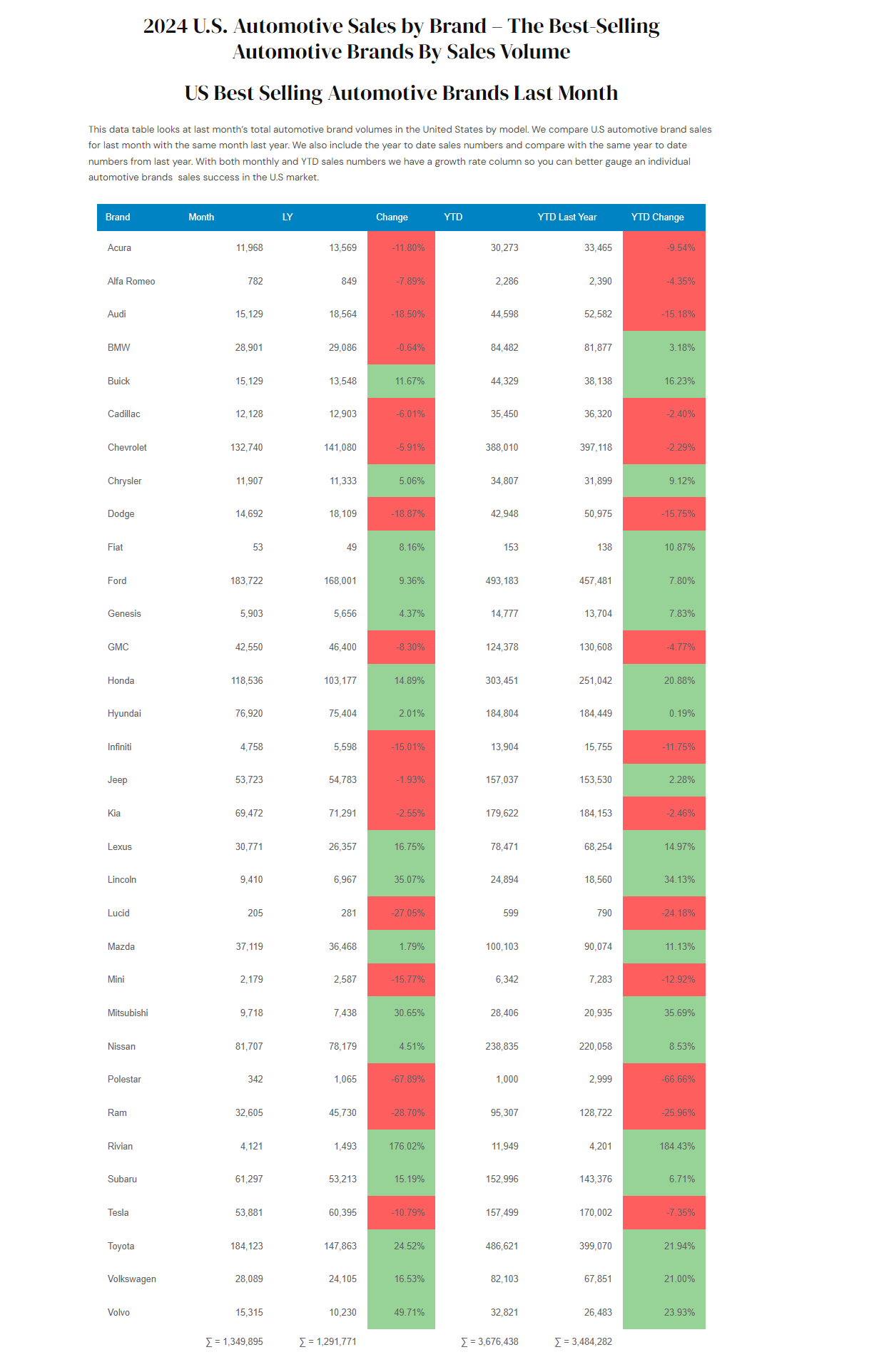

As Zach covered a few days ago, Tesla announced disappointing first quarter deliveries. I’m focusing on the US market, so I’m using the estimates from goodcarbadcar.net (Tesla doesn’t share US figures). At first glance, the 7% decline versus the 6% gain for the market doesn’t look too bad, but it is very disappointing considering that pricing on their best selling Model Y has dropped considerably.

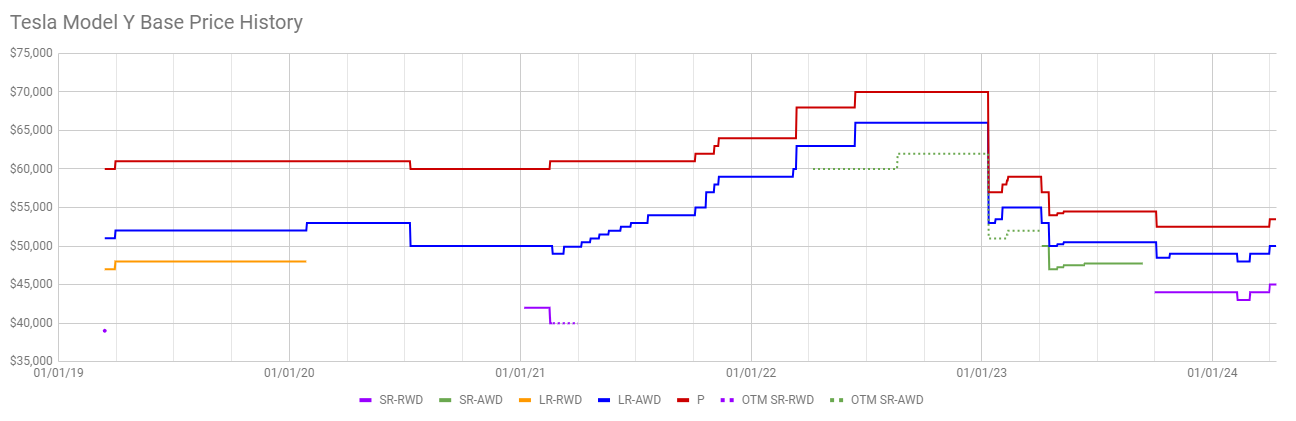

In the above table, I compared the price of the Long Range Model Y in the first quarter of 2024 to last year and the last quarter of 2022. I used the price tracker to get the prices, and where there where many prices for the quarter, I mentally averaged the prices weighted by length of time that price was available. I say mentally because I didn’t do it in a workbook, I just estimated the prices and rounded to the nearest thousand dollars. For the typical inventory discount, I listened to some videos from the DennisCW YouTube channel to get an idea. Most of us following Tesla know about the massive 29.7% price drop in the first quarter of last year, but I don’t see much discussion that prices have dropped an additional 19% in the last 12 months, resulting in a staggering 43% net price drop for the best selling car in the world! In addition, the tax credit became instant and is now available to many people whose income was too low to take advantage of it last year.

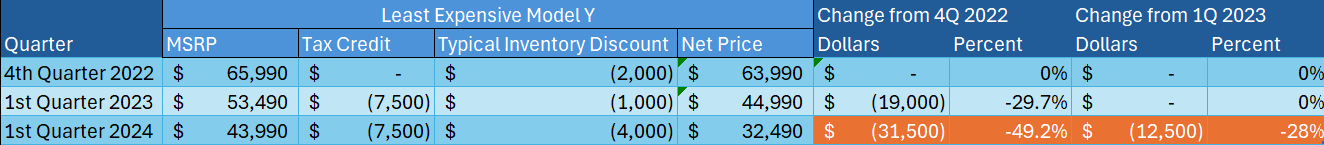

I used the same methods for this table, except I listed the least expensive Model Y available in each period. In the first two periods, that was the Long Range AWD, but in the most recent period, that is the RWD Model Y with 260 miles of range (instead of the 310 miles of range of the Long Range AWD). This shows the entry level Model Y price dropped even more than the apples to apples comparison I first showed. So, clearly, the price dropped considerably no matter how you look at it. From a personal standpoint, my daughter bought a Model Y a couple years ago for about $60,000, and one a few weeks ago for about $24,000 ($5,000 Colorado tax credit and some extra incentives offered the last week of the quarter explain why the price is lower than the $32,490 amount in the table above). The lower price enabled her to afford a second Tesla, even though the gas saving are minimal on that car due to only driving it about 6,000 miles a year. Improving safety and reducing maintenance and repair costs were the primary reasons for replacing the 20-year-old gas car (2003 Honda CR-V).

So, given the MASSIVE net price decreases explained above, why didn’t sales increase? That is a whole article in itself, but some reasons that come to mind are listed below.

- Troy Teslike has stated that Model 3 demand is strong, but that production in the US was limited due to ramping issues related to the Highland refresh.

- In addition, the Model 3 lost the federal tax credit, unless you use the leasing loophole. I think this may be the most significant of the reasons and explain most of the drop.

- Most people don’t know the prices have dropped so much. This is the whole “should Tesla advertise or just cut prices” debate. Even though Tesla does advertise now, most people still don’t know about the lower prices. [Editor’s note: Also, from my experience, most Tesla advertising doesn’t emphasize the lower prices. —Zachary Shahan]

- Many people (including Elon Musk) say the increase in interest rates is responsible for the drop in Tesla sales, but if that was the case, we would see poorer sales from other makes, so I think this is a minor issue.

- All the talk of the $25,000 Model 2 is Osborning some sales of the Model 3 and Y, but I think this is also a relatively minor issue.

- Donald Trump and other Republicans have really increased their attacks on electric cars. Although most of the points they make are either partially true or totally false, they have been very effective at causing a sizable group of people to say they will never buy an electric car. See the video below for more on this.

- Elon has made a lot of comments on X/Twitter that progressives don’t like. This is the group that likes electric cars the most. So, some people who would have bought a Tesla have either bought a different brand of electric or just bought a gas car because they don’t want a non-Tesla until those brands us the NACS connector and have access to most superchargers. See the video below for more on this.

Hyundai Had A Flat Quarter

As we covered in more detail in this article recently, Hyundai had flat sales versus the 6% gain for the market. That looks okay, but why didn’t they exceed industry growth like they have done for most of the last 30 years? I don’t know, but my guess is the supply chain issues that have plagued Toyota and Honda are finally resolved, so a lot of people who wanted those brands might have bought a Hyundai last year because they were available but Hyundai is not getting that extra boost this year. Let’s discuss their hybrid and electric car strategy.

Hyundai is halfway between the Tesla (we only make electric cars) and Toyota (we like hybrids) strategy. Hyundai makes gas cars, hybrids, plug-in hybrids, and electric cars. It makes a pretty good volume of all of those so that it is just up to the consumer to buy what they want. The quality of their hybrids and electric cars are good enough to win many awards, so I’d say they are decent. Hyundai offers two modern electric cars designed from the ground up — the IONIQ 5 and the 2023 CleanTechnica Car of the Year, the IONIQ 6! In addition, the company offers an electric version of its Kona subcompact crossover.

Hyundai’s EV sales jumped 62% in the quarter versus the first quarter of 2023, in spite of the fact that none of these are made in the US, so they don’t get the $7,500 tax credit unless they are leased. Hyundai (and Kia) have been much faster at pushing leasing to take advantage of that loophole than Tesla. They also let people buy out the cars at the end of the lease if they want. Hyundai was surprised by the details of the Inflation Reduction Act (IRA), so it is at a major disadvantage to Tesla, which has EV manufacturing in the US and some battery contracts that have enough materials from the right countries to get the full tax credit for most of their cars. Hyundai has been quick to build capacity in the US and I’m amazed it will be opening its megaplant in Georgia in about 6 months!

Toyota Had A Great Quarter

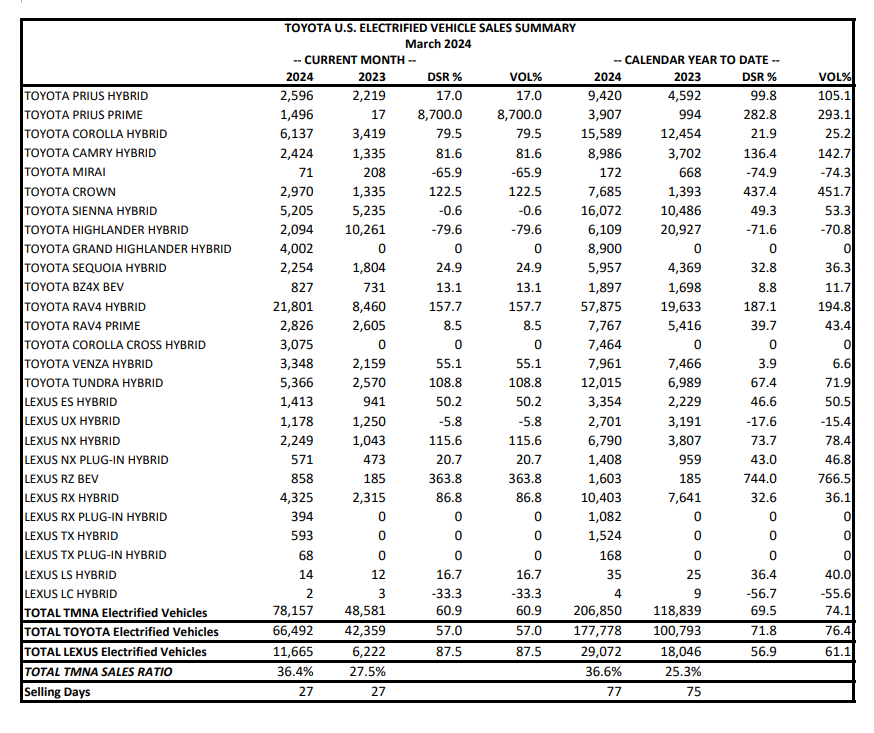

Toyota’s sales were up 22% for the quarter, and its “electrified” car sales (mostly hybrids, but a few plug-in cars) were up 76.4% over the first quarter of last year.

Looking at models, I can see that only 2% of their electrified production is fully electric, while 7% is plug-in hybrids. Although those are very low numbers, they are growing quickly, each increasing about 100% since last year. The Camry is Toyota’s second most popular car and only about 11% opt for the hybrid model, but the 2025 model coming out this spring will be 100% hybrid and may also (not announced, but rumored) be available as a plug-in model. Clearly, having reliable hybrids and plug-in hybrids is working for Toyota in the US market (it is failing miserably in the large Chinese and European markets).

This is the major risk for Toyota. If a market starts to go electric quickly (as is happening in China, Europe, and some other countries), Toyota is caught without a competitive product since it doesn’t make many EVs and the ones it does make aren’t that great. On the other hand, with the polls pretty even and the betting markets a tossup as to whether Biden will be re-elected or Trump will return to office, it’s worth noting that Toyota would fare very well in the US under a Republican administration. Even if Biden is re-elected, the new emissions rules give automakers the choice of making a lot of hybrids or fewer electric vehicles. They don’t care how you reduce emissions, as long as you do. Ted Ogawa recently said that he doesn’t even expect there to be demand for these recently lowered targets and Toyota plans to just buy credits instead of wasting resources designing and building electric cars he is convinced his customers don’t want. I think he is dead wrong and they will be caught without good products when the market realizes electric cars are great. But this year, he has been right and I have been wrong.

Conclusion

It is a crazy world we live in. In my opinion, Tesla has the best cars and the best plans, Hyundai has pretty good plans, and Toyota has the worst, but the first quarter has taught us that markets don’t move in straight lines. Especially as the car market has started to become more political, you can’t just pick winners by who has the best long-term strategy. Elections and campaigns are having all kinds of effects on both the automakers and the buyers of cars, and this is causing some very strange results. This quarter, the results are the opposite of how aligned the manufacturers are with a quick transition to electric cars.

I’m convinced that as more people discover that electric cars are great and that they have been lied to by the anti-EV crowd, companies that design good electric cars (like Tesla and Hyundai) will be rewarded, and those that slowed progress (like Toyota and the other Japanese automakers) will be punished. But if Trump is elected, the transition to electric cars in the US will likely be delayed a few years, as he discourages it.

Disclosure: I am a shareholder in Tesla [TSLA], BYD [BYDDY], Nio [NIO], XPeng [XPEV], Hertz [HTZ], NextEra Energy [NEP], and several ARK ETFs. But I offer no investment advice of any sort here.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.