Another Day, Another Hydrogen Transportation Firm Sinks Into Its Inevitable Fate

It’s been a while since I bothered to bash hydrogen for transportation or cleantech special purpose acquisition corporations (SPAC), but the intersection of the two just crossed my screen. I’m talking about Hyzon, the SPAC-funded US-based manufacturer of heavy vehicles.

Let’s start with SPACs and cleantech. These “blank check” companies raise capital through initial public offerings (IPOs) with the sole purpose of acquiring or merging with existing private firms, thereby bypassing the traditional IPO process. Historically, SPACs were used as a niche financial instrument, primarily for acquiring undervalued companies in niche markets or distressed assets.

However, that all changed after the cryptocurrency initial coin offering (ICO) craze was cracked down on by the US SEC and others, preventing the money bros on Wall Street from creating fat bonuses from vapor, other people’s money and delusions. That had followed the crowdfunding abuse of the early 2010s. That had followed the reverse mergers abuse of the 2000s. That had followed the dot-com IPO abuse of the late 1990s and early 2000s. Basically, SPACs are just the latest way that money bros have figured out as a way to exploit loopholes that protect retail investors from their greed.

NFTs were in there, of course. Currently, it’s looking like decentralized finance projects and tokenized securities are competing to be the next financial instrument that re-proves P.T. Barnum’s adage that there’s a sucker born every minute.

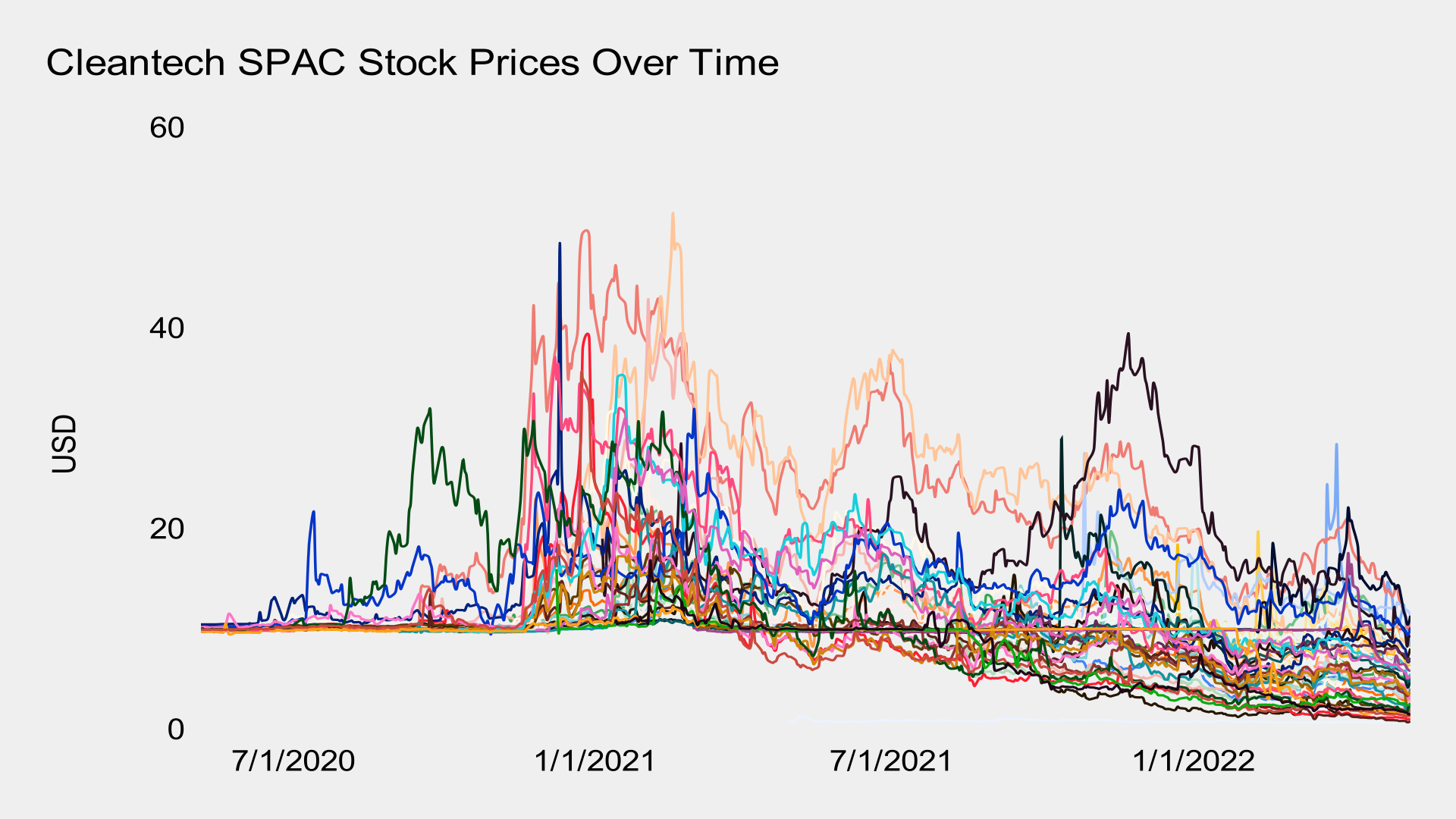

A couple of years ago, I assembled a data set of cleantech SPACs to trace the rise and fall of market capital of a bunch of firms which thought they’d found Willy Wonka’s golden ticket, the path to free money without having to prove that they had a useful product, a market, an actual business plan remotely tethered to reality, or any competence to deliver on the above. Some of the firms had useful, revenue-generating businesses that could have made the principals a nice living, but not made them rich.

The Wall Street guys, along with the venture capitalists who were looking for their exits and are complicit in every one of these bubbles, created a generic company with a vague target acquisition type referred as a thematic or sector-focus, listed it for $10 per share, then went hunting for current, privately-held companies that were desperate enough to sign up for very big fees to the SPAC creators. Greed overcame common sense in many cases, or common sense didn’t exist to begin with, as with the origami-eVTOL urban air mobility space, and the founders and seed investors of the firms got in bed with the Wall Street guys.

Because due diligence and SEC disclosures were barely required after SPACs were created, the Wall Street guys and the PR firms they hired weren’t required to be remotely honest or ethical in their assertions, presentations, and media. This has a long, long history. “Pump and dump” stock schemes, notorious for their deceitful manipulation of financial markets, stretch back to the early days of stock trading. In the late 19th and early 20th centuries, bucket shops flourished, allowing speculators to wager on stock price movements without actual ownership. Operators of these establishments often engaged in market manipulation akin to modern pump and dump tactics. The Roaring Twenties, marked by a stock market boom, witnessed rampant speculation and the rise of “stock jobbers,” who spread rumors and false information to inflate stock prices before offloading their holdings at a profit, leaving other investors with worthless shares. SPACs are just another iteration of the same, another weapon in the arms race between money bros and the Securities and Exchange Commission (SEC).

And so, to Hyzon Motors Inc., founded in 2020 by Craig Knight, Gary Robb, and George Gu. It focused on hydrogen fuel cell commercial trucks and buses. Initial funding came from private investments from firms including BlackRock, Fidelity Investments, Total Carbon Neutrality Ventures, and Hydrogen Capital Partners, at least some of which should have known better. In July 2021, Hyzon went public through a merger with the Decarbonization Plus Acquisition Corporation SPAC. Have a look at its stock chart and see if it was any different than any other SPAC.

Let’s see. The SPAC was created December 18, 2020. The reverse takeover of Hyzon was announced in February of 2021. Pumping ensued, hence the peak price of $16.50 per share and a momentary market capitalization of over $4 billion. The takeover was completed in July 2021 and the stock had already dropped due to the dump phase of the process by early SPAC investors. In September 2022, the SEC charged Hyzon, and in September 2023 Hyzon and a couple of its executives settled for almost $25 million in joint fines.

“According to the SEC’s complaint, Hyzon misrepresented the status of its business dealings with potential customers and suppliers to create the false appearance that significant sales transactions were imminent. The complaint alleges that Hyzon also falsely stated that it had delivered its first FCEV in July 2021, even going as far as posting a misleading video of the vehicle purportedly running on hydrogen, when the vehicle was not equipped to operate on hydrogen power. The complaint further alleges that Hyzon later falsely reported that it sold 87 FCEVs in 2021, when in fact it had not sold any vehicles that year.”

This is par for the course for SPACs. Of the 56 companies I had in my data set, 34 had class action lawsuits against them by investors who felt they were defrauded. Hyzon is far from the only SPACced firm that the SEC had brought charges against.

Hyzon’s stock price just kept dropping and dropping and dropping, so the retail investors who were deluded about the merits of hydrogen vehicles were out a lot of money. Not the money bros, of course. They got out early because that was the entire purpose. Does this look like any other hydrogen for transportation and energy stock charts?

Sure does. Back in 2000, hydrogen economy enthusiasm was running hot, hot, hot, and hydrogen IPOs saw absurd valuations. Plug Power, FuelCell Energy, and Ballard Power — which has lost an astonishing $1.3 billion or $55 million per year since 2000 — have very similar stock charts, just from an earlier wave of fiscal vehicles being exploited to avoid scrutiny. I haven’t seen a hydrogen for energy stock chart that doesn’t look like this.

Hyzon, of course, had expanded from the United States to Canada, the Netherlands, Germany, Australia, and China. If you are projecting world domination as part of your business model, you have to spend money maintaining the illusion that you are going to be selling trucks and buses globally.

But now the harsh and completely predictable reality has set in. In its Q1 2024 results, it revealed that it had lost $276.87 million to that point. NASDAQ is going to delist it, as its stock price has been below $1 since the beginning of 2024. On Monday, it announced that it was leaving all of the countries where it had set up shop. And today it announced that it was considering putting itself up for sale to … someone… anyone.

Day traders and volatility speculators loved SPACs. They undoubtedly love something else now. The SEC, whose job is to protect investors, doesn’t like any vehicle that sidesteps the requirement to ensure that investors actually have accurate information that enables them to make a good decisions, distinctly did not like SPACs. Those of us who are trying to ensure that big money flows to actual climate action are deeply unimpressed with them as well.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.