Volvo EX30 Ends April in 2nd Place — Europe EV Sales Report

In the meantime, Volkswagen is starting to recover its mojo.

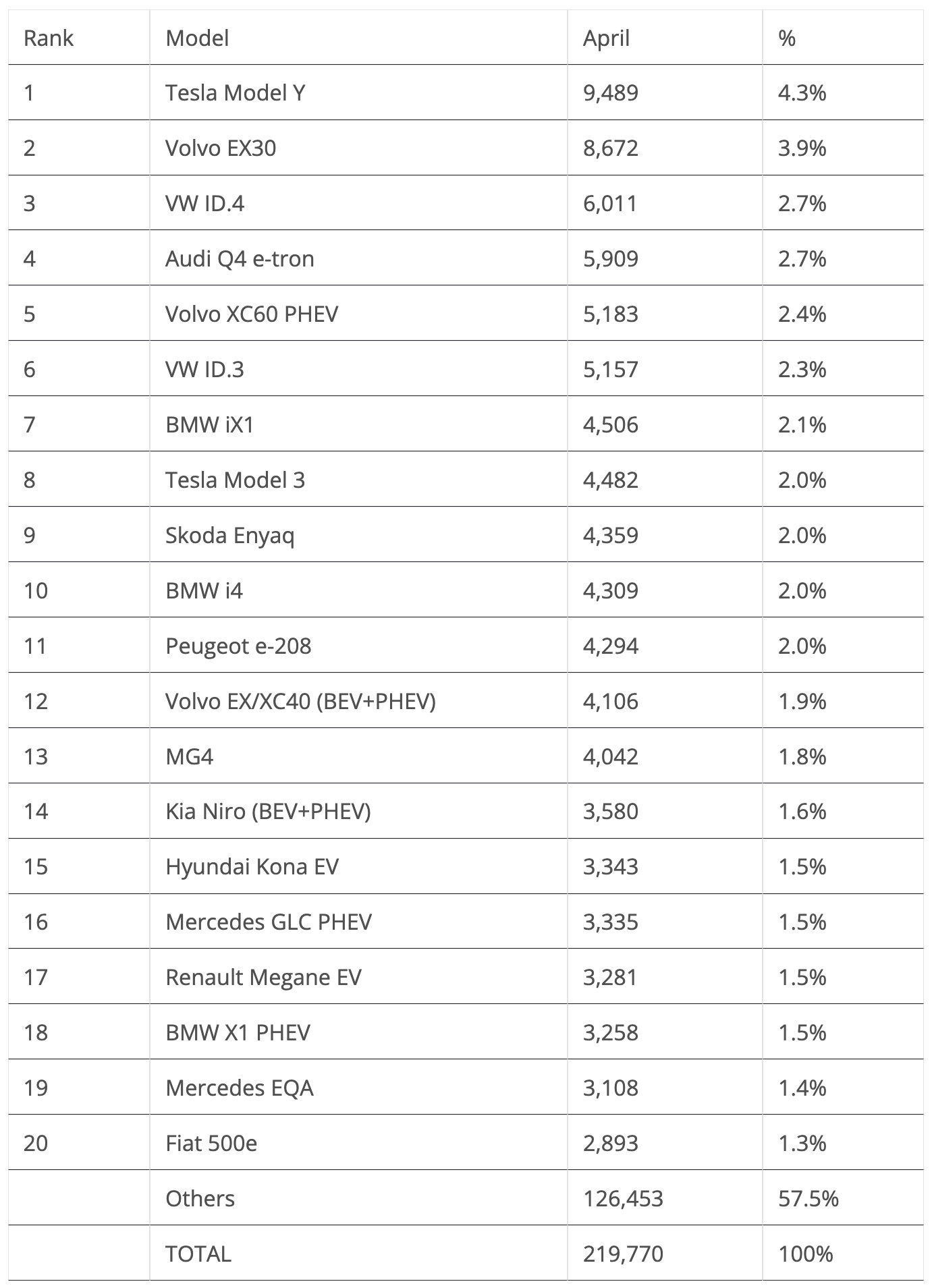

Some 219,000 plugin vehicles were registered in Europe in April, which is up 11% year over year (YoY). And while Tesla isn’t helping (in fact, Tesla’s deliveries were down 2% YoY in April), the plugin tally from Volvo, Volkswagen, and Peugeot, among others, is pulling the market upwards.

Taking a more focused examination of the market, plugins had more or less the same growth rate as the overall market, +12%, so there were no significant gains or losses when it comes to EV market share.

April’s plugin vehicle share of the overall European auto market was 20% (13% full electrics/BEVs). That result kept the 2024 plugin vehicle share at 21% (13% for BEVs alone) by the end of April.

Still looking at the YTD tally, BEVs (+14%) grew faster than PHEVs (+6%). Could this be the first sign that the BEV market is starting to heat up again? With new mass-market EVs (the Renault Scenic, Citroen e-C3, etc.) about to land, expect Q2 to mark a recovery from the Q1 sales blues, but significant growth should only come in the second half of the year.

Looking at the other powertrains on the market, plugless hybrids were the fastest growing technology in April, with +29% YoY growth, and they represented 30% of the total market. Added to the 20% of plugin vehicles, one can say that half (50%) of the European car market is already electrified … in some way. But for some to grow, others must come down, and diesel (- 1% YoY) is the biggest loser. Diesel vehicles had only 12% of the European passenger car market in April 2024, a far cry from the 50% share it had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2027, well before the 2035 ICE ban….

The highlights of the month were the recently introduced Volvo EX30, which climbed into 2nd, and the fact that the Tesla Model 3 was out of the top 5. But let’s look closer at April’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. In April, the midsizer had 9,489 registrations, which was down 11% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 19% YoY in the first quarter of the year in Europe, as the market’s natural limits are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y’s performance is not as amazing as it once was. And this time it even had some competition for the leadership position, with the runner-up Volvo EX30 ending some 800 units behind. Sure, 800 units is not 80, so the US crossover didn’t really have to sweat to keep the #1 spot, and with May and June expected to be better months for Tesla, do not expect the Model Y to be contested in the next couple of months. In July, however … we’ll see. Regarding last month’s performance, the Model Y’s biggest European markets included France (1,437 units), Germany (1,102 units), and the UK (1,080 units), with the Netherlands (1,048 units) being the remaining country posting four-digit results.

#2 Volvo EX30 — The China-made (but with a Swedish passport) crossover is starting to live up to the hype, climbing to the 2nd spot on the table in only its 4th full month on the market. The model had 8,672 registrations in March. Expect the EX30’s sales to continue strong in the coming months, maybe even crossing the five-digit barrier (in May? June?). Currently Volvo’s cheapest model(!), starting out at 39,000 euros vs. the 40,000 euros of the gasoline XC40, the EX30 is Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. And considering that it is still ramping up deliveries, it wouldn’t be surprising if in July it would be able to beat the Tesla Model Y in the race for #1. Regarding the EX30’s April results, the distribution of deliveries shows a push in three markets, with the Netherlands (1,459 units) leading and Norway (1,191 units) and Germany (1,064 units) being the only other ones above 1,000 deliveries.

#3 VW ID.4 — The Volkswagen crossover was back to a podium position in April, thanks to 6,011 registrations, a new year best. With demand recovering, due to the recent refresh, the ID.4 is again back in the game. A top 5 position is still possible for 2024, but on the other hand, it will be nearly impossible to repeat the bronze medals of 2022 and 2023, as both of the Teslas and the Volvo EX30 should be this year’s podium contenders. Unless, of course, a 25% tariff rate hits the Made-In-China vehicles, around summer time…. But enough of futurology and back to the crossover’s April performance, its biggest market was by far its domestic one, with Germany having 2,234 registrations, followed by Norway (986 registrations) and Denmark (506 registrations).

#4 Audi Q4 e-tron — Although it didn’t reach record sales levels, the compact crossover had a positive month, allowing it another top 5 presence. With 5,909 sales, it seems the Q4 is immune to the sales fluctuations that have been affecting the MEB-platform models, probably due to its premium positioning in the market. Looking into the near future, it will be interesting to see if the upcoming Q6 e-tron midsize SUV will steal sales from its smaller sibling. Something to follow throughout the rest of the year…. Looking at April’s performance, the highlight is the UK (1,415 registrations), but Germany (1,184 registrations) and Belgium (777 registrations) also deserve a mention.

#5 Volvo XC60 PHEV — Volvo continues on a roll. Not only did the EX30 reach the 2nd spot, but the veteran plugin hybrid SUV (the current generation dates back to 2017) scored a near-record performance! With 5,183 sales, the XC60 PHEV helped the Swedish brand to place two models in the top 5, which is no small feat. The future EX60 is sure to be a hot seller…. Regarding the XC60’s April performance, its main markets were Germany (1,312 registrations) and its native Sweden (1,246 registrations), with the UK (555 registrations) following them from a far.

Looking at the rest of the April table, the highlights go to two models, both of them BEVs, and both just outside of the top 5, which makes them candidates for future presences among the tope sellers. The #6 spot of the VW ID.3 was celebrated with 5,157 sales, the hatchback’s best result since August, with the recent refresh surely helping the VW model’s performance, while the BMW iX1 ended the month in #7, with 4,506 sales, another strong result for the BMW compact crossover as it looks to match the Audi Q4 e-tron’s volumes.

This is a symptom that the sales blues derived from the end of BEV incentives in some markets is finishing, as proven by the fact that BEVs represented 66% of plugin sales in April, above the 64% average of 2024, AND in an off month from Tesla. As such, expect BEVs to continue gaining share over plugin hybrids during May and June, with pure electrics probably representing over two thirds of plugin sales by the end of Q2.

As a reminder, in 2023, BEVs ended with 67% of the plugin market, so anything above that score will be good news for pure electrics.

A reference goes out to the Hyundai Kona EV’s return to the best sellers list, in 15th, benefitting from the full ramp up of the second generation of the crossover. On the other hand, the Fiat 500e was just 20th last month, with 2,893 units, a 29% sales drop, which in part is explained by the introduction of the Fiat 600e small crossover, but with the upcoming introduction of new small EVs, the little Italian could use a refresh. Preferably with LFP batteries and lower prices….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Below the top 20, the highlights were 1) the Peugeot e-2008 crossover finally having access en masse to the new CATL batteries, which, added to the recent refresh, allowed it to be #21 in April, reaching 2,832 registrations, and 2) Toyota’s continued awakening — the Toyota BZ4X had another positive result, with 2,321 registrations in April. It seems the Sleeping Giant is finally on the right track.

Another highlight is the Mercedes EQB. With 2,602 registrations, it is getting close to a top 20 position. This model is a sort of paradox. It has pretty average specs (to put it mildly…) — with 100 kW charging speed and no more than 535 km WLTP range, especially considering the price (it starts at 59,000 euro). For less, you could have models with much higher electric range (700 km WLTP with the new Peugeot e-3008 100 kWh version), faster charging (234 kW for the Kia EV6), or just buy an equally premium compact crossover (Audi Q4 e-tron) with better specs and saving 5,000 euros in the process, but all these competitors miss an unique selling point of the EQB: the Mercedes has 7 seats. And to find something similar to the EQB offering 7 seats, you will have to spend at least €70,000…. So, until the future Peugeot e-5008 lands, sometime towards the end of this year, the Mercedes EQB has this corner of the market all to itself.

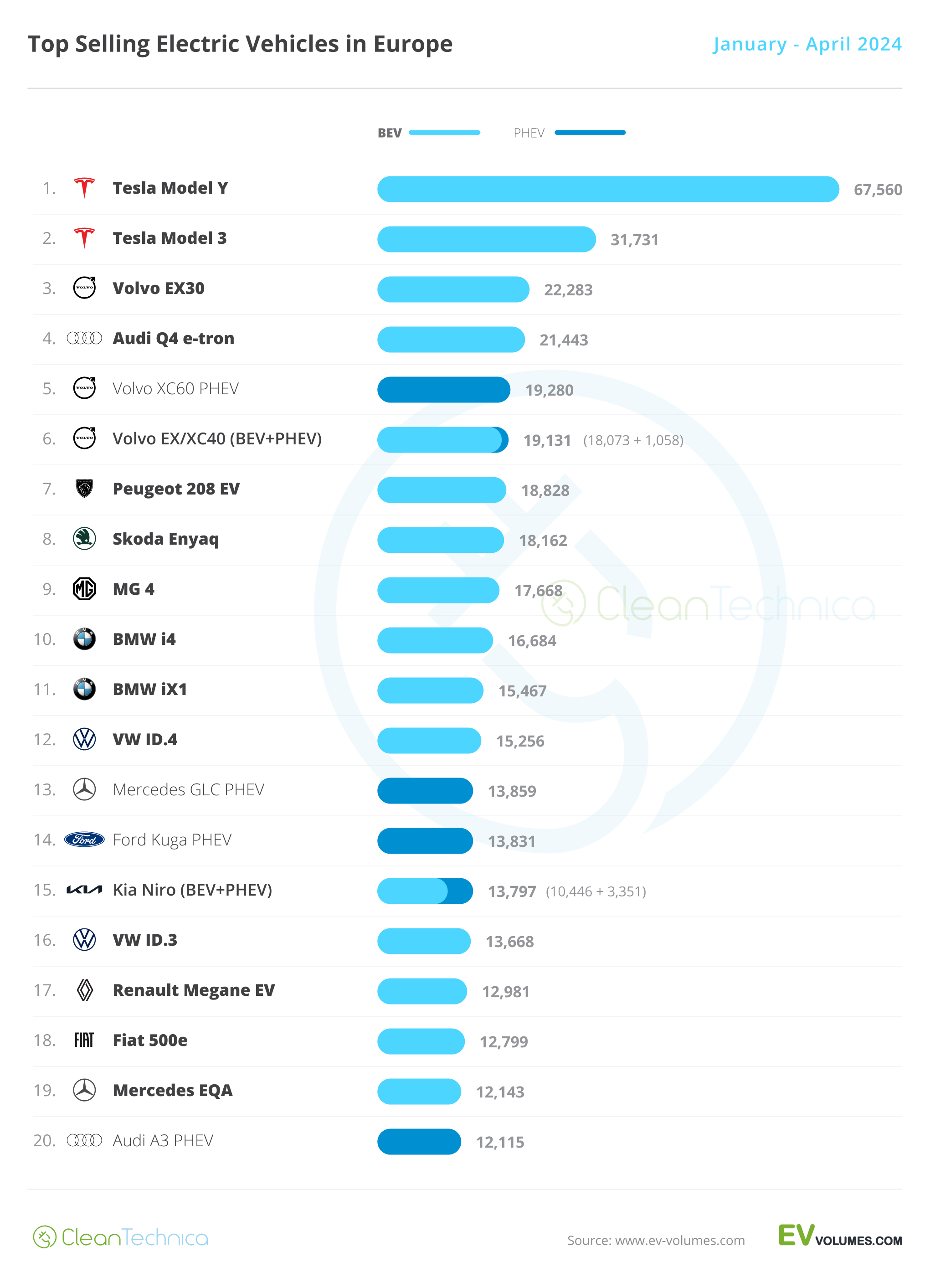

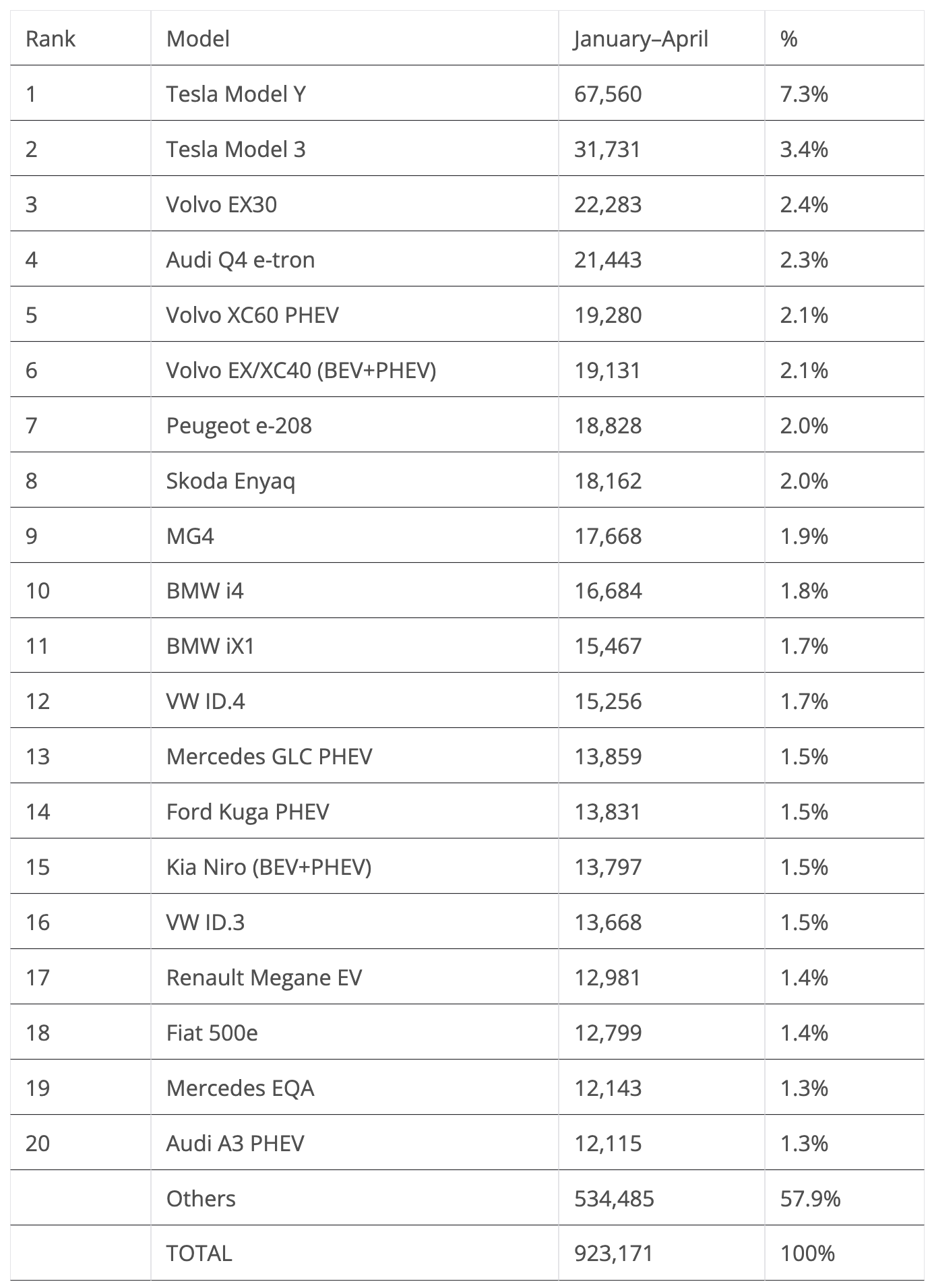

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having twice as many deliveries as the runner-up Tesla Model 3, the leadership position is already taken. However, below it, the runner-up position could still be at play. And while the difference between the new #3 Volvo EX30 and the #2 Tesla Model 3 is over 9,000 units, the truth is that the small crossover shortened the distance by more than 4,000 units in April alone…. Imagine if the Volvo model repeats this performance also in July and October, all while running at the same pace as the Tesla in the remaining months of the year — we might have a close race between these two at the end of the year….

Unless, of course, the Made-in-China tariffs increase significantly during the summer, as that black swan-like development would disrupt the market, by not only increasing the price of these two models, but by emboldening the sales of the Made-in-Europe models. Heck, even the VW ID.4 could have a shot at a podium presence!

Still on the top 5, while the Audi Q4 e-tron lost its podium position to the fast rising Volvo EX30, which jumped from 8th to 3rd in just one month, the German crossover did manage to increase its distance compared to the Volvo XC60 PHEV to more than 1,000 units, thus preventing the Swedish from closing in on a #3 plus #4 standing in the table. Still, with three Volvos in the top 6 positions, the Gothenburg-based carmaker can’t really complain much….

Elsewhere, the remaining position changes happened in the second half of the table, with the hot selling BMW iX1 climbing one position, to 11th. The German is set to climb a couple more positions in the following months and stay in the top 10 until the end of the year.

But the big news came from Volkswagen, with the ID.4 jumping six positions, into 12th. The crossover is racing to recover lost time. Meanwhile, the VW ID.3 has (re-)joined the table, in 16th, with the hatchback now looking to regain a position in the top half of the table.

Just outside the top 20, the Hyundai Kona EV is now #21, with 12,043 registrations, fewer than 100 units behind the #20 Audi A3 PHEV. So, it looks like another BEV will replace a PHEV model in May, after the VW ID.3 had done the same in April. If this was to happen, we would have just three PHEV models in the table next month. Not bad, eh?

In the 2024 overall brand ranking, Volvo was one of the biggest growers in April, jumping 59% YoY(!), in no small part thanks to the all-new EX30. That model alone represented more than a quarter (26%) of Volvo’s 33,767 sales in April. So, yes, new BEV models can push up sales of legacy OEMs — they just need to believe (and invest) in them. Oh, and another interesting factoid: plugins represented over half of Volvo sales in April in the European market.

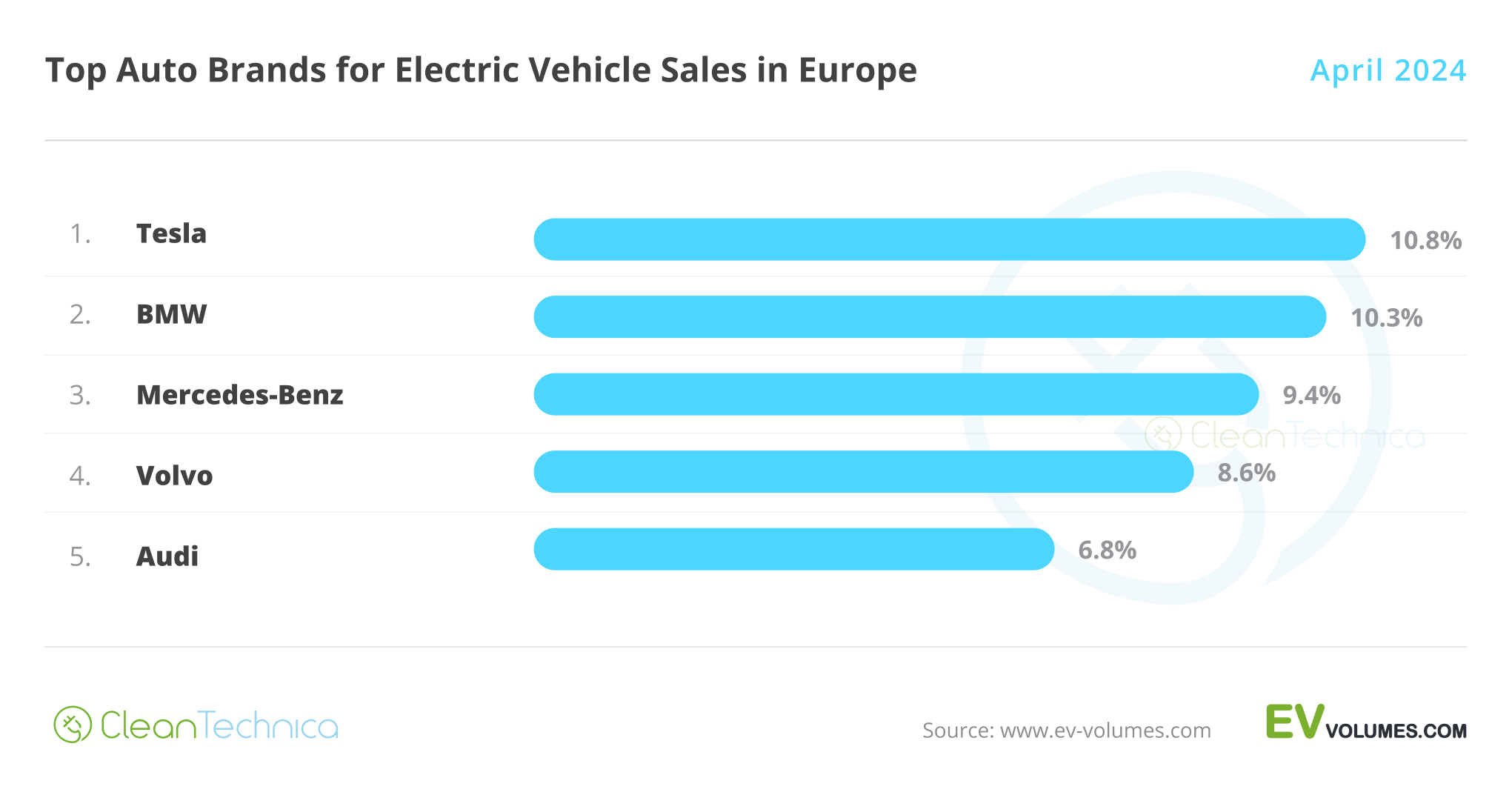

As for the plugin auto brand ranking, despite sinking in April (10.8% in April vs 12.2% in March), Tesla is still leading with a comfortable lead over #2 BMW, with 10.3%. That’s the same share it had in the previous month.

3rd placed Mercedes (9.4%) has remained stable in its podium position, thanks to positive results across its looong lineup, but #4 Volvo (8.6%, up from 8.2%) is rising fast, so a lot can still happen between them.

Finally, #5 Audi (6.8%, down from 7.1%) is sliding, so we could see a position change happening in May, especially considering that #6 Volkswagen (6.4%) is returning to form. Expect the Wolfsburg make to surpass its premium sister brand, if not already in May, then surely by June.

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect it to do everything in its power to push sales up and reach the 3rd position. The only problem it has is that Volvo is also going strong…. Well, nothing that a Made-in-China tariff raise wouldn’t solve … but I digress.

A sign of the times, all top 5 brands are premium makes, with the best selling mainstream brand, Volkswagen, only in 6th, and Peugeot in 7th, with 5.4%.

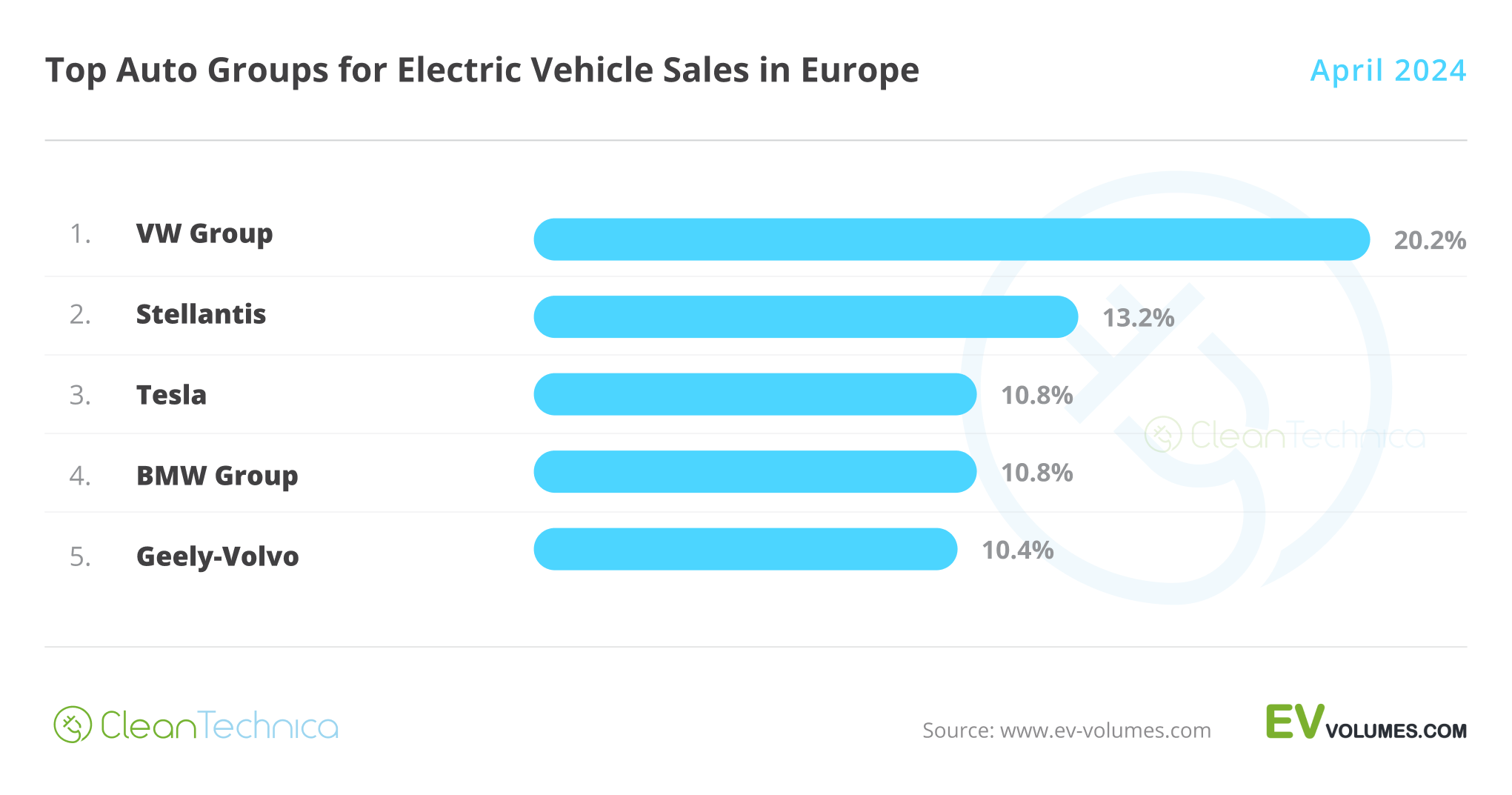

Arranging things by automotive group, Volkswagen Group benefitted from a sharp rise from its namesake brand to go up by 1.1%, to 20.2%. So, the German OEM is keeping a comfortable lead over the competition.

There was a position change regarding the second position, with previous runner-up Tesla (10.8%, down 1.4% from the previous month) losing its position to Stellantis (13.1%, up 1.1%). The multinational conglomerate benefitted from a positive month across its several brands, but especially from Peugeot, to surpass Tesla in the race for the silver medal. (“You’re welcome” — said battery maker CATL.) But with Tesla expected to have a peak in June, expect another position change by then….

Off the podium, #4 BMW Group was slightly down, now at 10.8%, while #5 Geely–Volvo continued on the rise, gaining 0.4% share and climbing up to 10.4%. With BMW Group now in sight, the question isn’t so much if they will be able to surpass the German OEM, but if Geely will be able to get into the race for the 2nd spot.

With the Mercedes-Benz Group (9.9%) stable in 6th, #7 Hyundai-Kia (8.2%) does not look able to climb positions anytime soon.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.