Green Hydrogen To Rescue “Stranded” Offshore Wind Resources

When green hydrogen is in play, the issue of stranded assets takes on a whole new meaning. Stranded assets commonly applies to fossil energy resources that lose market value in a decarbonizing economy. Wind energy stakeholders also apply the term to offshore sites where the wind is optimal, but no grid connection is available. Instead of throwing up their hands in defeat, some are turning to green hydrogen and the right combination of circumstances for an assist.

Green Hydrogen Could Rescue Stranded Offshore Wind Resources…

The combination of green hydrogen and offshore wind has crossed the CleanTechnica radar every now and then. In one iteration of the idea, excess electricity from offshore wind turbines is shunted to electrolyzer systems primarily at night, when wind speeds pick up but electricity demand slows down (for more background on green hydrogen, see our hydrogen archive).

The electrolysis can take place onshore, if a grid connection is available. If none is available, the electrolyzers can be co-located with offshore wind turbines, either on their own platforms or attached to individual turbines. All else being equal, wind farms could be located in areas farther from shore, where wind speeds are optimal, even if no grid connection is feasible. The hydrogen produced from offshore electrolyzers would be transported to shore by pipeline or by ship.

…If The Right Circumstances Come Together

On the downside, the economic case for building new wind farms far offshore for the exclusive purpose of producing green hydrogen is a difficult one to make.

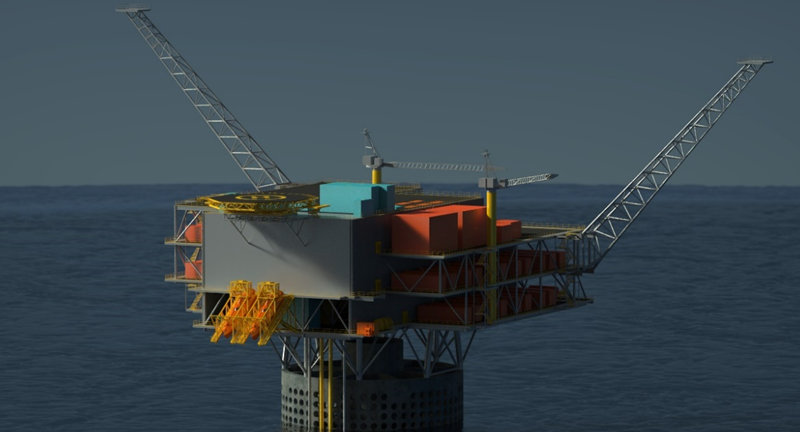

One factor that could help improve the financial picture is the potential for deploying pre-existing infrastructure. And, that’s where the right circumstances are coming together. The Scottish organization Net Zero Technology Centre has been studying the potential for repurposing offshore oil and gas rigs for green hydrogen production.

The program, called HOP2 for Hydrogen Offshore Production Project, is based on a feasibility study from 2018. Both new and existing infrastructure costs are included in the calculations.

“Wind Europe have identified that a considerable portion of the low-cost offshore wind resource in Europe is located within the North Sea, much of which is at a significant distance from shore and from existing electrical infrastructure,” Net Zero explains.

“This configuration presents a significant opportunity for the production and storage of hydrogen at the source of electricity production offshore, leveraging existing infrastructure in the region,” the organization adds.

The Green Hydrogen Pieces Are Coming Together, Slowly

A follow-on study in 2020 “clearly identified that producing hydrogen offshore on repurposed or new installations may be the most cost-effective option for large scale green hydrogen production,” as described by Net Zero.

In the latest news, on June 19, the engineering and consultancy firm Apollo announced completion of another HOP2 study, in which it offered “viable options for a new offshore asset or the reuse of existing offshore asset substructures.”

Apollo noted that repurposing an existing substructure is a challenging task, but the firm also advocated for further investigation, stating that “the potential for significant cost savings justifies additional effort to more precisely determine the footprint requirements for such assets.”

Among other hydrogen projects, Apollo has collaborated on a feasibility study involving both onshore and offshore wind for an electrolyzer facility at the Sullom Voe Terminal on Shetland.

The Green Hydrogen Race Is On

The clock is ticking on Net Zero’s green hydrogen plans, both onshore and off. The organization has already committed to a 10-gigawatt export pipeline to the EU, based in part on a determination that green hydrogen from Scotland could provide at least 22% of Germany’s hydrogen by volume within the next 21 years, and potentially up to 100%.

Meanwhile, green hydrogen stakeholders in other countries have been busy. In one particularly interesting development, on June 11, the global investment manager Copenhagen Infrastructure Partners and the leading offshore wind developer Vattenfall launched Zeevonk, a new joint venture aimed at bringing the planned 2-gigawatt IJmuiden Ver Beta offshore wind farm to life off the west coast of the Netherlands.

An electrolyzer system is also part of the project, but the really interesting part is a floating offshore solar array with a peak power output of 50 megawatts. Floating solar is a relatively new field that is rapidly gaining traction on reservoirs and other human-built infrastructure. Sending solar panels out to sea presents next-level challenges, and it will be interesting to see how Zeevonk plans to tackle them.

What About Hydrogen Fuel Cell Vehicles?

Of course, no conversation about hydrogen is complete without a mention of hydrogen fuel cell electric vehicles. Though slow to catch on in the US, fuel cell EVs are nudging their way into the market in Europe and elsewhere.

One recent development is a new collaboration between Renault Group’s HYVIA branch (a joint venture with the US firm Plug) and the French hydrogen taxi specialist HYPE. Announced on June 12, the partnership is aimed at coordinating green hydrogen supply with fueling stations, and coordinating fueling station availability with fuel cell EVs.

Other automakers with a stake in the fuel cell EV field have been focusing on the market for larger vehicles with greater power needs. Quantron is one such example. On June 12, the German firm Quantron, which has a branch in the US, announced the introduction of new fuel cell light- and heavy-duty trucks, with the aim of seeking “cost parity for zero emission commercial vehicles.”

That’s going to be a tough nut to crack, considering the high cost of both fuel cells and green hydrogen, though Quantron has stated that it will deploy a network of partners to achieve the cost parity goal.

Meanwhile, Back In The Lab…

For those of you new to the topic, green hydrogen refers primarily to hydrogen pushed from water in an electrolyzer system, with electricity supplied by renewable resources. That’s a sharp contrast with the conventional way to produce hydrogen, which involves extracting it from natural gas or coal.

Aside from its use as a fuel, hydrogen has multiple industrial and food system applications, so cleaning up the hydrogen supply chain is a key element in the global decarbonization movement.

The high cost of electrolyzer systems has been slowing things down, but researchers have been hammering away on new cost-cutting strategies. One area of focus has been to replace the expensive platinum commonly used in electrolyzer catalysts with ruthium, as recently described by researchers in Italy.

Transporting and storing hydrogen gas is also coming under the cost-cutting microscope. A research team at Stanford University is among those tackling that angle through the emerging field of liquid organic hydrogen carriers, which involves deploying hydrogen in the form of “liquid batteries,” leveraging its function as an energy carrier and storage medium.

Follow me @tinamcasey on Bluesky, Threads, Instagram, and LinkedIn.

Photo: Existing offshore oil and gas rigs could be repurposed as green hydrogen production facilities, using electricity from offshore wind farms (courtesy of Apollo).

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.